Grid Battery Metals (TSXV: CELL) has commenced a significant drilling...

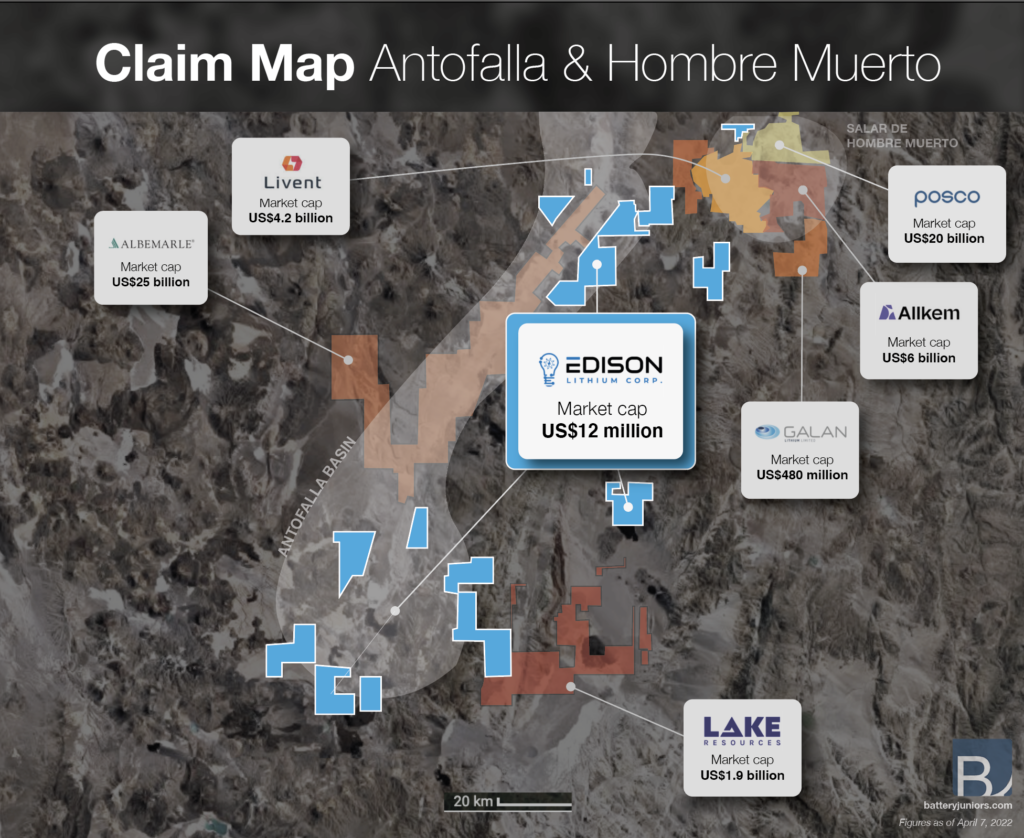

Read MoreThe spot price of lithium is pushing new highs. Because of recent price movement, M&A activity in the lithium sector is already beginning to heat up from major mining corporations. During the past year, Argentina’s lithium triangle has without a doubt been the hotspot for lithium M&A activities, especially the area around the Hombre Muerto Salar, attracting large M&A transactions and large investments into current operations.

So, where to look if you want to invest in a junior mining lithium project located in Hombre Muerto? There are only two advanced publicly traded companies with a presence in the Hombre Muerto Salar…

In June 2021, Edison Lithium acquired a 100% equity interest in Resource Ventures S.A., a Catamarca, Argentina-based lithium exploration company. Resource Ventures owned or controlled the rights to more than 148,000 hectares (over 365,700 acres) of prospective lithium brine claims in Argentina, primarily located in two geologic basins in northern Catamarca Province, Argentina known as the Antofalla Salar and the Pipanaco Salar.

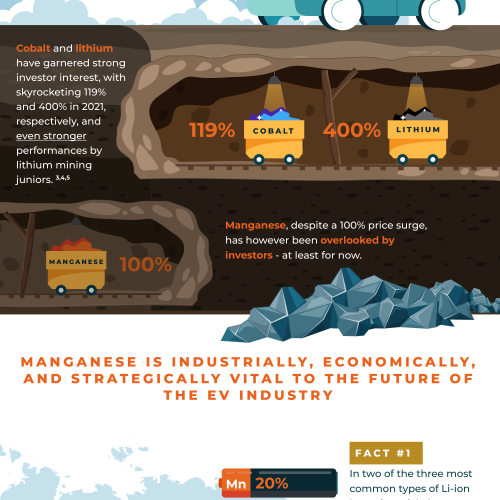

Electric vehicles (EV) will account for 55% of the market by 2030, propelling forward the demand for Lithium-Ion (Li-ion) batteries – the leading type of EV battery. In turn, this powerful trend has led to massive demand growth for the main components of Li-ion batteries, namely nickel, cobalt, lithium – and Manganese.

Demand for lithium is increasing rapidly due to the proliferation of electric batteries dependent on the mineral. McKinsey forecasts the battery cell market will grow at a minimum of 20% per year through 2030, which would put the global value at $360 billion. Depending on market conditions and the possible positive impacts of economies of scale, the firm believes the global electric battery market could plausibly reach $410 billion by that time.

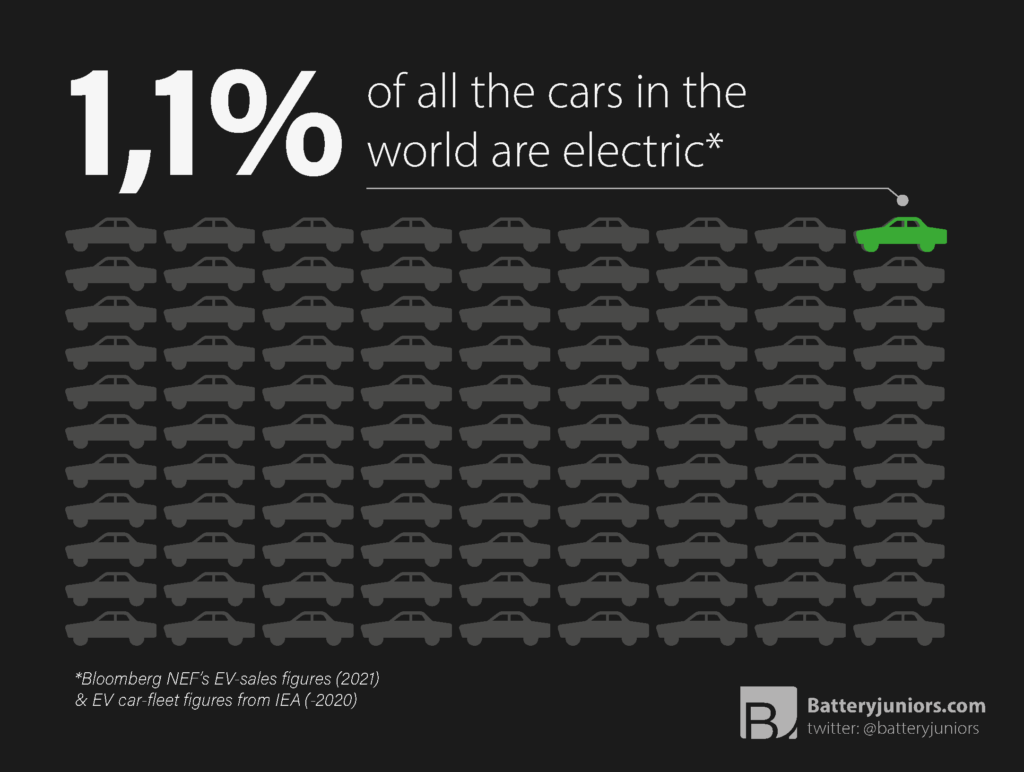

The global electric vehicle fleet in 2022 currently entails approximately 16.6 million cars. To put this figure into perspective, there are about 1.45 billion cars in the global car fleet as of 2022. With this in mind, electric vehicles only account for a mere 1.1% of the global car fleet.

Lithium South Completes Phase I Environmental Study for HMN Li Project

Lithium South Development Corporation (TSX-V: LIS) accomplished the Phase I...

Read MoreLithium Ionic Achieves Key Milestone in Brazil’s Lithium Valley

Lithium Ionic Corp. (TSX-V: LTH, OTCQX: LTHCF, FSE: H3N) has...

Read MoreLithium South’s Leap into the Lithium Market: A Promising Venture in Argentina’s Lithium Triangle

A Promising Venture Begins In an industry where innovation and...

Read MoreLithium South’s Strategic Advances: A Milestone Well Completion and Promising Economic Assessment Amidst Argentina’s Lithium M&A Surge

Lithium South Development Corporation, a key developer in the Argentine...

Read MoreThe EV Revolution Accelerates as Battery Costs Plummet: A Double-Edged Sword for the Industry

In the rapidly evolving landscape of electric vehicles (EVs), a...

Read MoreThe Daily Lithium Report – May 18, 2023 on May 18, 2023 at 2:16 pm

Daily news and insights across the lithium mining industry

Read MoreThe Daily Lithium Report – May 17, 2023 on May 17, 2023 at 1:33 pm

Daily news and insights across the lithium mining industry

Read MoreThe Daily Lithium Report – May 16, 2023 on May 16, 2023 at 1:30 pm

Daily news and insights across the lithium mining industry

Read MoreLithium South’s Leap into the Lithium Market: A Promising Venture in Argentina’s Lithium Triangle

A Promising Venture Begins In an industry where innovation and...

Read MoreLithium South’s Strategic Advances: A Milestone Well Completion and Promising Economic Assessment Amidst Argentina’s Lithium M&A Surge

Lithium South Development Corporation, a key developer in the Argentine...

Read MoreThe EV Revolution Accelerates as Battery Costs Plummet: A Double-Edged Sword for the Industry

In the rapidly evolving landscape of electric vehicles (EVs), a...

Read MoreReal time Value Analysis

Live market data (15-min delay)

Fair comparison using the same future LCE-pricing forecast

When calculating how much lithium-ions it takes to store 70kWh of power from a theoretical point of view, you’re going to end up with 5 to 6 kg of lithium metal.

But is this the whole truth?

The EV battery industry is undergoing a paradigm shift that so far has remained under the radar of most investors. The market share for Manganese-bearing NCM cathodes is expected to increase from 45% in 2020 to 75% by 2030. This is the consequence of the increasing presence of Manganese and its outright replacement of cobalt in EV battery cathodes. News releases by government entities, academia, and major multinationals highlight a trend that is already in full swing…

China produces over 90% of the world’s high purity electrolytic Manganese metal (HPEMM) and high purity Manganese sulphate monohydrate (HPMSM) – the only ones that can be used in Lithium-ion battery production.

Lithium prices continuous to remain at close to their all-time high, after a record-breaking 400% run up in 2021:

Two main factors are fuelling this powerful trend:

Record Electric Vehicle (EV) Sales – Sales of EVs, the main source of Lithium-Ion (Li-ion) battery demand, are blowing away the most optimistic forecasts in 2022, despite an overall weak automotive sales market. Global passenger EV sales skyrocketed 60% year-on-year in March 2022, compared to a -18% fall in non-EV purchases. …

On May 12th, ambitious Canadian mining junior Manganese X (TSXV: MN) announced very promising results from the independent Preliminary Economic Assessment (PEA) for its wholly-owned Battery Hill project located near Woodstock, New Brunswick. The PEA highlights robust economics, fast investment payback times, a longer than expected mine life (originally 25 years), and an above par IRR profile:

New Article:

New Article: Volkswagen, Yorkton Ventures, BYD, NIO: E-Mobility 2022 - The Tesla Hunters Are Coming!

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)