The Dawn of the Electric-Vehicle Era: A Critical Lithium Supply Situation and Three Promising Lithium Stocks

Disrupting the Automotive Industry

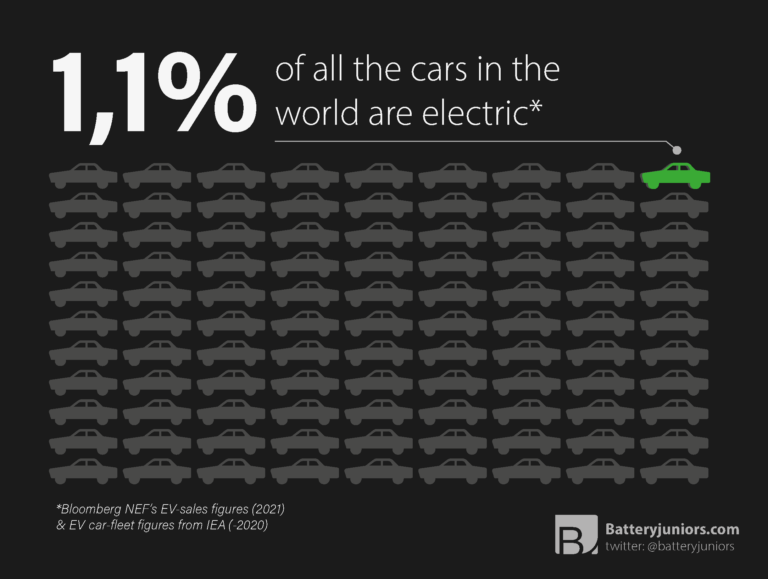

The global electric vehicle fleet in 2022 currently entails approximately 16.6 million cars. To put this figure into perspective, there are about 1.45 billion cars in the global car fleet as of 2022. With this in mind, electric vehicles only account for a mere 1.1% of the global car fleet.

So, what are the stakeholders in the vehicle industry up to? Is the electric vehicle revolution really going to happen? Yes, it is happening, and it is happening now!

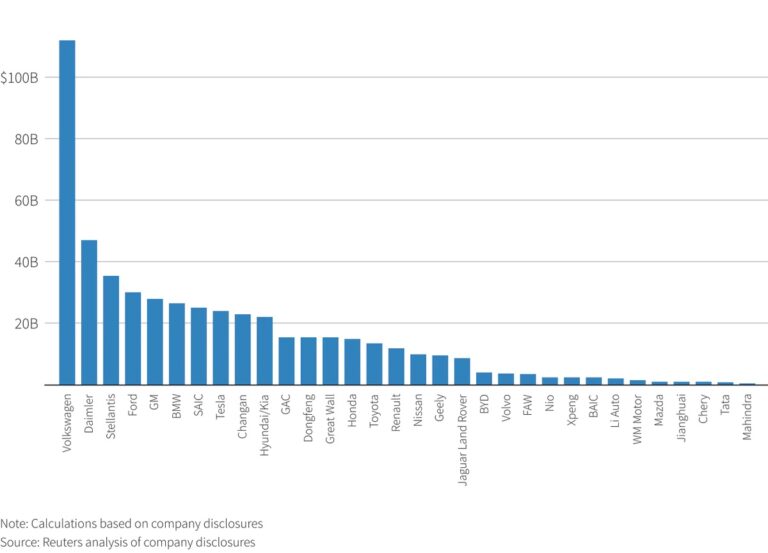

Major car brands around the world plan to invest enormous amounts of money to be able to benefit from the electric vehicle transition. Most recently, Toyota announced that it is planning to invest 4 trillion yen, or $35 billion to build 30 battery-powered electric vehicles by 2030. In a similar fashion, Reuters recently wrote that global automakers plan to spend more than $500 billion to ramp up electric vehicle production through 2030. These companies include major automakers such as Daimler, Tesla, Ford, GM, and VW.

A Lithium Supply Crunch Is Upon Us

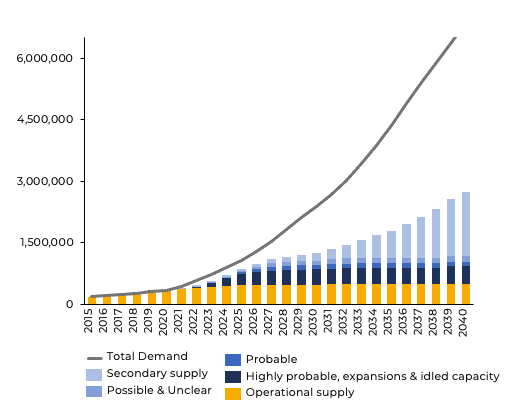

Even with as little as 1.1% of the global car fleet currently electrified, major automakers are now staring down the barrel of a long-term structural deficit for certain critical battery materials, with lithium being one of the most exposed minerals. Benchmark Mineral Intelligence (BMI) gathers data on supply and demand, covering most, if not all planned global battery production. BMI forecasts that lithium demand will increase significantly in the years to come, as will the supply gap.

It usually takes between five and ten years to transition from an initial discovery to production. With over $500 billion in planned downstream investments to protect, major car brands will have to act, and they have to act fast. Some stakeholders are beginning to realise the severity of the situation, which was one reason for the increased M&A activity in the lithium sector last year. We believe that it is just a matter of time before we see these automakers making much larger upstream investments in the lithium space.

Three Promising Lithium Stocks

1: Critical Elements Corp: A Semi-Permitted, Pre-Construction Lithium Company Forgotten by the Market

Ticker: $CRE

Market Cap: $298 million (Feb 9 2022)

Critical Elements Corp: Introduction

Critical Elements Corp. controls 100% of the Rose Project, an advanced hardrock lithium project in Quebec, Canada. The project is a high-purity spodumene project, with low iron and low mica content fit for the production of lithium hydroxide for EV batteries. Critical Elements Corp. has a market capitalization of C$284 million and recently conducted a $30 million bought-deal financing approximately 30% higher than their current share price.

The Rose Project

The project can be categorised as one of the most advanced lithium projects in North America. Back in 2017, the company published an impressive feasibility study for the Rose project. We will cover the economics of that study later in this article. An Environmental Impact Study was submitted in 2017 and deemed complete by the CEAA in March 2019. Additionally, they successfully completed a Lithium Carbonate Pilot Plant in 2017 and a Lithium Hydroxide pilot plant in 2018. As you can tell, they did a lot of the heavy lifting several years back.

More recently, the company received federal-level approval for the Rose Project in August 2021. The company is now awaiting the completion of the provincial permitting process. When they receive the provincial permit, they plan to begin construction of phase one: a production facility for high-quality spodumene concentrate. The intended year of initial production from the facility is 2023. If everything goes as planned, they will be one of the first, if not the first, large-scale lithium operations to come online in North America.

Economy

With current all-time high lithium prices, the high end of the sensitivity analysis appears to be the better choice to assess the project’s current value. With a pricing of US$900/tonne SC5, the project shows a C$1,026.2 billion after-tax net present value using a 8% discount rate, a payback period of 2.4 years, and an impressive 44.4% after-tax IRR.

The Management Team

The management team has relevant experience in de-risking large-scale projects. Noteworthy, two key members of the management team are the former Rockwood Lithium CEO and CFO, who successfully sold Rockwood to Ablemarle for US$6.2 billion back in 2015.

The Investment Opportunity

To summarise, the company holds one of very few construction-ready lithium projects in Canada and has put together a highly experienced management team. The project is one of very few North American producers that might be able to come online in the years ahead, filling the need for domestic lithium supply from EV manufacturers in North America. The company has yet to sign any off-take agreements or strategic partnerships, but we believe that it might happen very soon. Given the relatively low valuation compared to the after-tax net present value and many possible near-term triggers, including potential strategic partnerships, offtakes, provincial permitting, construction launches, and others, we believe that the company has a very exciting future and is well worth a look.

2: Vision Lithium: A Very Active Lithium Junior Exploration Company With Multiple Promising Projects and a Low Share Price

Ticker: $VLI

Market Cap: $38 million

Vision Lithium: Introduction

Vision Lithium is a junior exploration company focused on exploring and developing battery mineral assets including lithium and copper, primarily in Canada. In this article we will focus on the lithium properties, but the company controls multiple properties in different commodities:

- Godslith Lithium Project, Manitoba

- Cadillac Lithium Project

- Sirmac Lithium Project, Quebec

- Dome Lemieux Copper Project, Quebec

- New Brunswick Red Brook-Epithermal-Benjamin Cu-Zn-Ag Projects

- New Brunswick St. Stephen Ni-Cu-Co Project (50%)

The Godslith Property

The Godslith Property is considered to be its flagship project. The property was actively explored by INCO between 1958 and 1961. In an internal report dating back to those years, INCO reported a resource estimate of 4.8 Mt grading 1.27% Li2O. The company does not treat the historical estimates as “mineral resources,” but indicates that there is significant lithium mineralisation present on the property.

The Sirmac Property

Sirmac, the second lithium property located in Quebec was previously explored by Nemaska Lithium, which completed a very successful drilling campaign on the property, spending more than $2 million on exploration work. The project holds a historical resource of 185,000 t measured, and 79,000 t of indicated resource, both grading 1.4% Li2O, and another 40,000 t of inferred resource at 1.1% Li2O. The drilling confirmed multiple intersections over 2% Li2O, with one hole grading over 2.98% Li2O, approaching the grade of the famous Talison’s Greenbushes deposit in Australia, which is the highest-grade hard-rock deposit in the world. More recently, in February 2021, the company announced that they had successfully produced 99.99% pure lithium carbonate from lithium concentrate derived from the Sirmac Lithium Property in Quebec, Canada.

The Cadillac Property

Regarding the third and last lithium property, the company announced in the beginning of December 2021 that it had signed a definitive property purchase agreement for the Cadillac Project near Val-d’Or. The exploration program is fully funded for 2022 with impressive channel sampling conducted in December 2021, grading up to 4.8% Li2O. A maiden drill program for the property was initiated in January 2022. The property was described in the following way by the CEO:

“We believe the potential for additional lithium discoveries within the main cluster area is excellent and the larger property also has tremendous upside potential for discovery…We plan to aggressively explore the Property over the winter by drilling the main cluster of dikes and to plan and complete field work next summer over the large tract of land.”

The Investment Opportunity

Since the announcement of the promising metallurgical results, which made the share price increase significantly, the share price has been declining from it’s highs of $0.95 and is now trading with a share price of $0.17. With the acquisition of the new promising Cadillac Project, a strong project portfolio, and an aggressive approach to increase shareholder value in the months ahead, this could mark a good entry point to buy a very active lithium junior exploration company at an attractive valuation

3: Yorkton Ventures Inc: The Cheapest Way to Invest in Canadian Lithium Exploration?

Ticker: $YVI

Market Cap: $10.7 million

Yorkton Ventures: The Company

Yorkton Ventures is a junior exploration company focused on its gold and lithium properties in Quebec, Canada. This article will focus on the two newly acquired lithium projects that the company purchased in the last two months:

- The Cyr-Kapiwak Property

- The Sirmac Property

The Cyr-Kapiwak Property

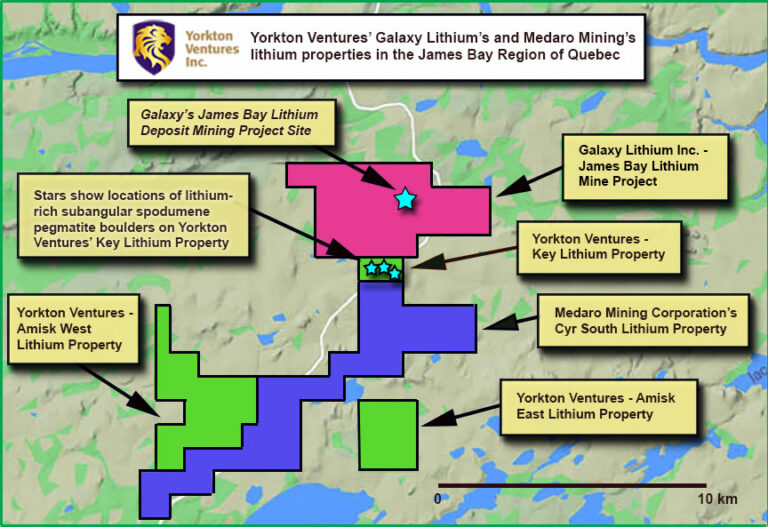

The Cyr-Kapiwak Property was purchased in December 2021 and consists of three claim groups, covering a total area of 2,220 hectares. The claim groups are located adjacent to the planned James Bay Mine, owned and controlled by Allkem (previously Galaxy Resources), which boasts a resource estimate of 40.3 Mt at 1.4% Li2O, making it one of the larger hard rock lithium deposits in Canada.

Historical exploration work on the property was conducted by Rock Teck Resources back in 2009. They found boulders on the Kapiwak Property grading up to as high as 2.9% Li2O. The report suggested that the source of the boulders could be from a non-outcropping land area adjacent to the James Bay deposit to the south, pointing straight towards the Cyr-Kapiwak Property now controlled by Yorkton Ventures. The report outlined recommendations for future work, including trenching and follow-up drilling on the property. The Cyr-Kapiwak properties also border Medaro Mining Corp’s Cyr property on both sides, as displayed by the image below.

The Sirmac East Property

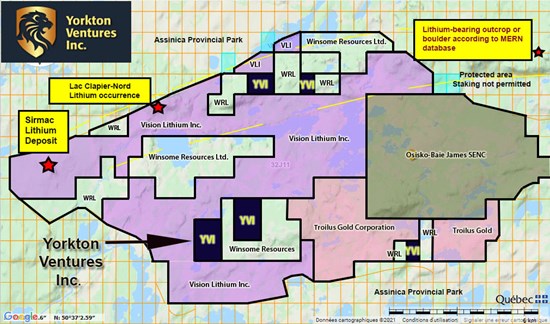

The second property was acquired in the beginning of 2022, called Sirmac East covering 656 hectares. The property claims are located adjacent to Vision Lithium’s Sirmac Lithium project, historically explored by Nemaska Lithium, which completed more than $2 million on exploration work on the property back in 2014. The campaign was considered a success with multiple intersections above 2% Li2O. In 2021, Vision Lithium produced a 99.99% lithium carbonate with spodumene concentrate sourced from the Sirmac Property. Here is how the company describes the property:

“The Project area is considered to be highly prospective for lithium hosted in spodumene-bearing pegmatites, with at least two historic lithium occurrences (Sirmac Lithium and Clapier Lithium) mapped in the western part of the region. In the northeast part of the region, at least one lithium-bearing boulder has been found on land with Provincial park status. The position of this boulder indicates that the area between the boulder location and the Sirmac lithium deposit (as well as the Clapier lithium showing) has strong potential for further discoveries.” – Yorkton Ventures Website

Transaction Terms

Both the Cyr-Kapiwak Property and Sirmac Property were purchased on very favourable terms, each with a low cash payment of just $25,000, 250,000 common shares, and 250,000 warrants, exercisable at $0.60 for 18 months from the closing of the deal, along with a 2% NSR that can be reduced to 1% for a $1 million cash payment at any time.

The Investment Opportunity

Taking a look at other lithium exploration companies in the region with various amounts of exploration work conducted to date offers an indication on how the market values lithium exploration companies in Quebec and the potential upside when such a project advances. The proximity to larger lithium companies with more advanced projects such as Critical Element’s Rose Project, Allkem’s James Bay, and Livent’s Nemaska (Whabouchi), could open up future M&A activity in the region.

When considering Yorkton Venture’s valuation, the company has been trading with the same market cap as they did before the acquisition of the new lithium properties. Assuming that the company was fairly valued solely based on its gold properties prior to the purchase of the new lithium claims, the new lithium projects are currently trading with zero value assigned to them by the market. Given the valuation of surrounding lithium junior exploration companies, as well as the major discount and highly prospective nature of the properties acquired by the company, we could see Yorkton’s valuation multiply if the upcoming trenching and exploration campaign turns out to be a success this summer. Ultimately, Yorkton Ventures appears to be one of the cheapest ways to invest in Canadian lithium exploration.

DISCLAIMER:

NO INVESTMENT ADVISE THE INFORMATION PROVIDED IN THIS ARTICLE DOES NOT CONSTITUTE INVESTMENT ADVICE, FINANCIAL ADVICE, TRADING ADVICE, OR ANY OTHER SORT OF ADVICE AND YOU SHOULD NOT TREAT ANY OF THE WEBSITE’S CONTENT AS SUCH. BATTERYJUNIORS DOES NOT RECOMMEND THAT ANY FINANCIAL INSTRUMENT SHOULD BE BOUGHT, SOLD, OR HELD BY YOU. DO CONDUCT YOUR OWN DUE DILIGENCE AND CONSULT YOUR FINANCIAL ADVISOR BEFORE MAKING ANY INVESTMENT DECISIONS. At the time this article was originally posted, Yorkton Ventures INC was an advertiser on Batteryjuniors.com. ACCURACY OF INFORMATION BATTERYJUNIORS WILL STRIVE TO ENSURE ACCURACY OF INFORMATION LISTED IN OUR CONTENT ALTHOUGH IT WILL NOT HOLD ANY RESPONSIBILITY FOR ANY MISSING OR WRONG INFORMATION. BATTERYJUNIORS PROVIDES ALL INFORMATION AS IS. YOU UNDERSTAND THAT YOU ARE USING ANY AND ALL INFORMATION AVAILABLE IN THIS ARTICLE AT YOUR OWN RISK. NON-ENDORSEMENT THE APPEARANCE OF THIRD-PARTY ADVERTISEMENTS AND HYPERLINKS ON CONTENT PRESENTED BY BATTERYJUNIORS DOES NOT CONSTITUTE AN ENDORSEMENT, GUARANTEE, WARRANTY, OR RECOMMENDATION BY BATTERYJUNIORS. DO CONDUCT YOUR OWN DUE DILIGENCE IN REGARD TO THE INFORMATION PROVIDED.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)