Value Analysis of South American Lithium Juniors

See how the valuation of the South American lithium companies & how their projects compare (Financial data updated on a daily basis)

Interested in how we put the analysis together? Click here

Project Value per $ invested

Price Adjusted Net Present Value / Enterprise Value

Net Present Value:

Project's valuation presented in technical reports.

Enterprise Value:

Is the current Market Cap - Cash + Debt.

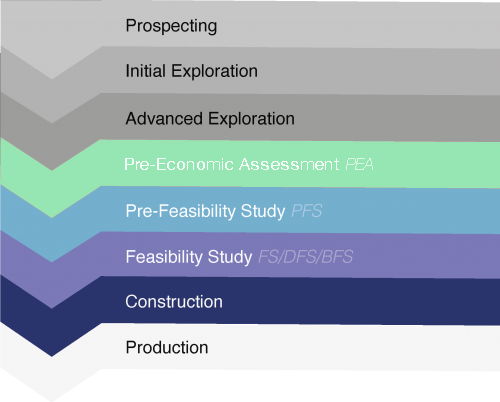

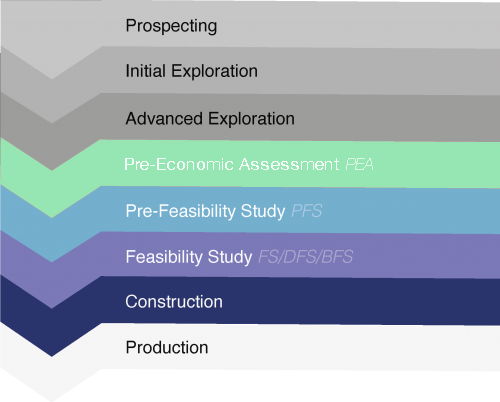

Chart color: Project Stage –Read more

Resource:

Lithium per $ invested

Measured & Indicated / Enterprise Value

Resource:

Potentially valuable, and for which reasonable prospects exist for eventual economic extraction.

Measured:

High level of confidence

Indicated:

Reasonable level of confidence

Inferred resource is not included

Chart color: Project Stage –Read more

Reserve:

Lithium per $ invested

Proven & Probable / Enterprise Value

Reserve:

Valuable and legally, economically, and technically feasible to extract

Proven Reserve:

90-percent or above likelihood of commercial extraction.

Probable Reserves:

Likelihood of recovery over 50-percent but under 90-percent.

![]()

![]()

Chart color: Project Stage –Read more

Project Value in relation to

Current Value

Price Adjusted Net Present Value / Enterprise Value

Net Present Value:

Price adjusted project valuation presented in technical reports. Based on $20,000/t LCE pricing found or interpolated from data in the technical reports.

Enterprise Value:

Is the current Market Cap - Cash + Debt.

Chart color: Project Stage, Read more

How much of the project’s value is left to be priced in?

Price Adjusted Net Present Value (8%) & Enterprise Value

Net Present Value:

Price adjusted project valuation presented in technical reports. Based on $20,000/t LCE pricing found or interpolated from data in the technical reports.

Enterprise Value:

Is the current Market Cap - Cash + Debt.

Chart color: Project Stage, Read more

Resource Size in relation to How much is priced in & Lithium per $ invested

M&I Resource / (EV/Price Adjusted NPV) / (Resource: Measured & Indicated/EV)

M&I:

Measured and Indicated Resource in Lithium Carbonate Equivalents (LCE)

EV/NPV:

Enterprise Value (EV) in relation to the project's Net Present Value (NPV)

Resource/EV:

Resource in Lithium Carbonate Equivalents (LCE) in relation to Enterprise Value (EV)

Not available on mobile platforms

This section is too wide and is not yet available on mobile platforms. Visit through a tablet or a computer to access the analysis. Sorry for the inconvenience!

Size: Resource Estimate – All Company Projects (Inferred not included)

Chart color: Project Stage Read more

Advertisement

About the analysis

Only projects post-PEA stage

To be able to compare project economics, the analysis only includes projects post-PEA stage.

Pricing

The same price projection of $20,000/t LCE, or $2,000/t SC6 were used for all projects.*

Resource

Only the resource qualified as measured or indicated will be presented in the charts

*For projects where the company had chosen a pricing forecast different from the one used on this site, the NPV & IRR were interpolated from provided values in the companies released technical documents. More information on each projects NPV & sensitivity analysis on the relevant company’s profile page.

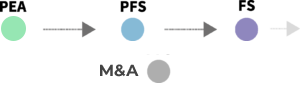

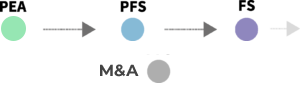

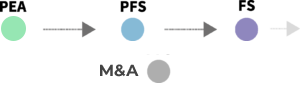

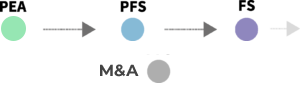

Chart colors: Based on the most recently released public technical report

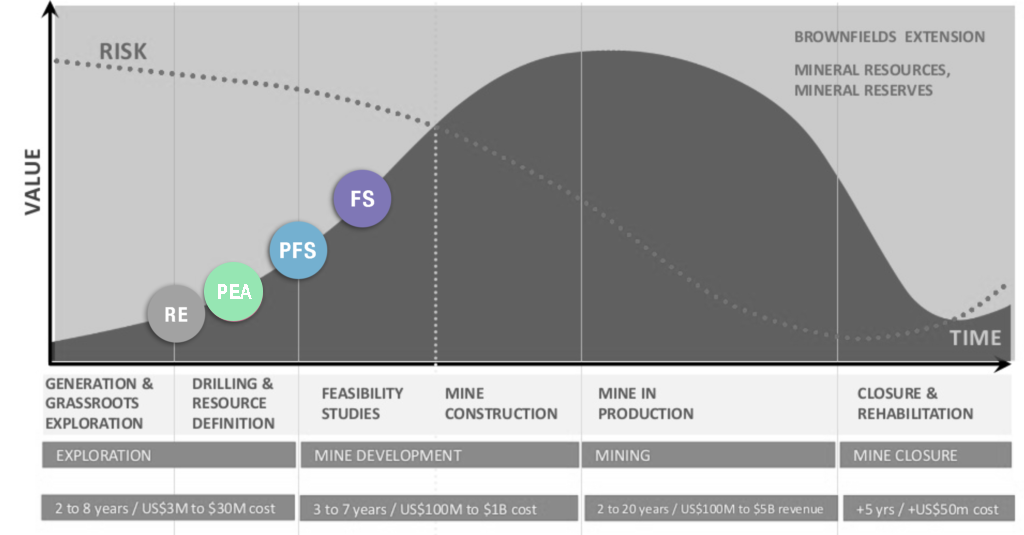

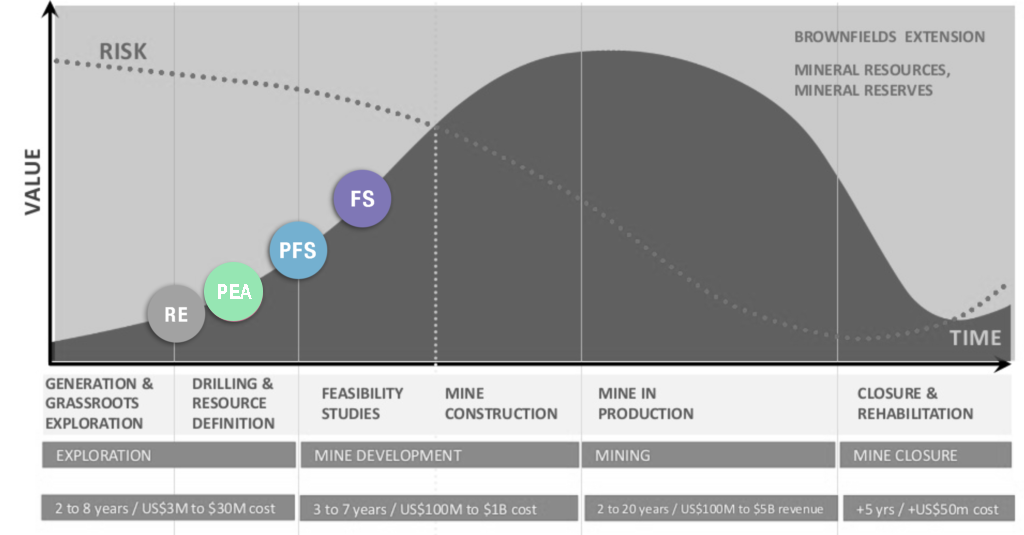

The resource development stages: Where in the development cycle are the technical reports released?

Advertisement

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)