In the rapidly evolving landscape of electric vehicles (EVs), a significant shift is underway. The cost of EV batteries, a pivotal component dictating the overall price of electric cars, is witnessing a historic downturn. This trend, spearheaded by industry giants like CATL and BYD, is not just reshaping the market dynamics but also bringing to light the intricate balance between demand stimulation and the sustainability of battery metal supplies.

The Cost War: A Catalyst for Change

The onset of 2024 has marked a remarkable phase in the EV industry, with Tesla initiating a series of price cuts reminiscent of the previous year’s strategy. However, the real game-changer lies hidden in the aggressive cost reduction strategies adopted by CATL and BYD, the world’s leading EV battery manufacturers. These industry behemoths are restructuring their production lines and integrating cost-saving technologies to slash the price of their LFP cells to an unprecedented $0.04/Wh (Notebookcheck). This drastic reduction, nearly half of the prices a year ago, is setting the stage for a fierce price war, promising a ripple effect of affordability across the EV spectrum.

The Ripple Effect: Beyond Just Pricing

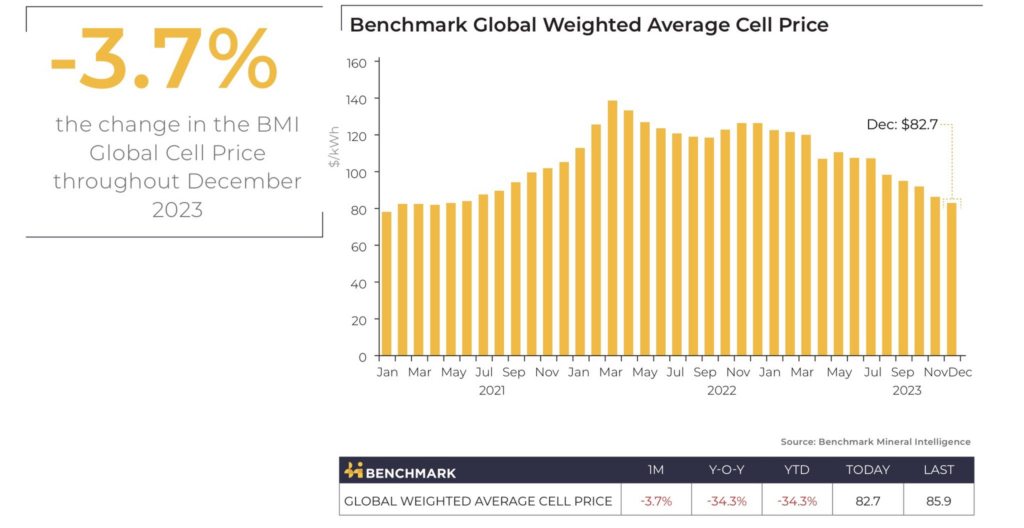

The plummeting battery costs are not just altering price tags but are also shaping consumer demand and market expansion. As noted by industry analyst Simon Moores on X (formerly Twitter), lithium-ion battery cell prices reached $82.6/kWh in December 2023 and are projected to dive further in January 2024, hitting all-time lows. This decline, attributed to the decreasing prices of all battery raw materials, is poised to fuel intriguing contract negotiations among Original Equipment Manufacturers (OEMs) and catalyze a major trend in the EV sector (Simon Moores on X).

The Future of Battery Costs: A Vision Becoming Reality

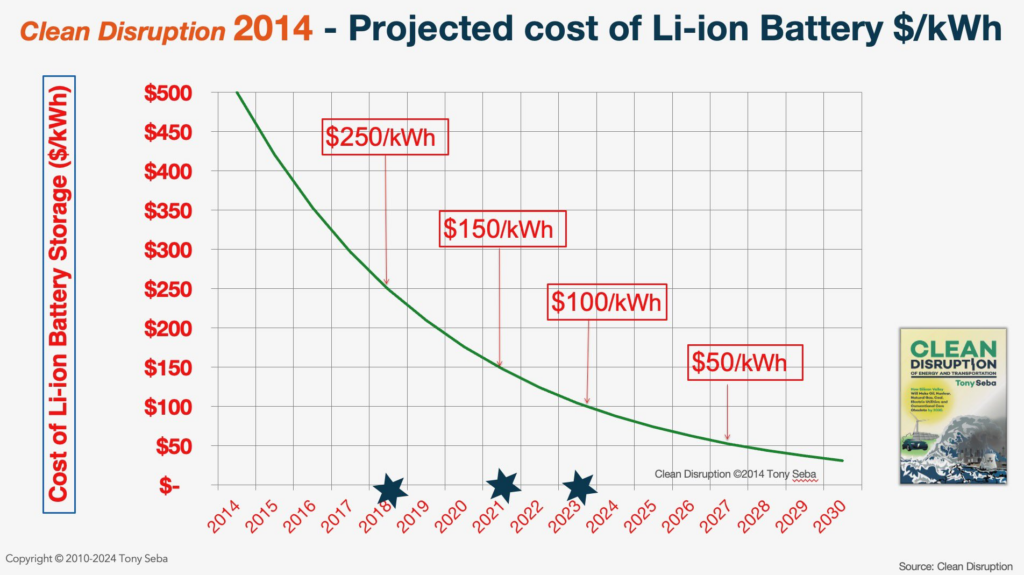

The trajectory of battery cost reduction is not just a current phenomenon but has been a subject of visionary predictions. Renowned thought leader Tony Seba, in his 2014 book Clean Disruption, forecasted that Li-ion batteries would reach the cost milestone of $50/kWh by 2027, a projection that seemed overly optimistic at the time. However, recent developments indicate that this milestone might be achieved even sooner than expected, particularly by China. Seba’s foresight underscores the rapid pace of innovation and cost efficiency in the battery sector, reinforcing the transformative potential of the EV market (Tony Seba on X). This aligns with the broader industry trends, where the aggressive cost reduction strategies by major players are not just meeting but exceeding the boldest of predictions, setting the stage for a more affordable and sustainable EV future.

A Double-Edged Sword: The Supply Conundrum

While the declining battery costs herald a new era of affordability and accessibility in the EV market, they cast a shadow on the future of battery metal supplies. The current price environment, while beneficial for short-term growth, raises concerns about the long-term sustainability of battery metal supplies. The lower price points might deter new projects from entering the market or securing the necessary financing, potentially leading to a supply crunch in the face of escalating demand. This aspect was highlighted in a recent Wall Street Journal article, emphasizing the friction added to the energy transition due to persistently low battery metal prices (Wall Street Journal).

In conclusion, the EV industry stands at a pivotal juncture. The ongoing battery cost war, while a boon for EV proliferation and consumer adoption, also calls for a balanced approach to ensure the longevity and stability of battery metal supplies. As the industry navigates this complex terrain, the decisions made today will undoubtedly shape the future of sustainable transportation.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)