In short

Location:

Argentina

Total Area of Claims

148,000 ha

Hectares

Stage:

TR

Technical Report

Company Highlights

-

A future pure-play lithium stock

With the planned spin-out of its cobalt project, the company will be positioned well to leverage from a booming lithium market as a promising early-stage project situated in the famous lithium triangle.

-

Large land holdings

Controls over 148,000 hectares of prospective land in Argentina after a recent acquisition of Resource Ventures SA.

-

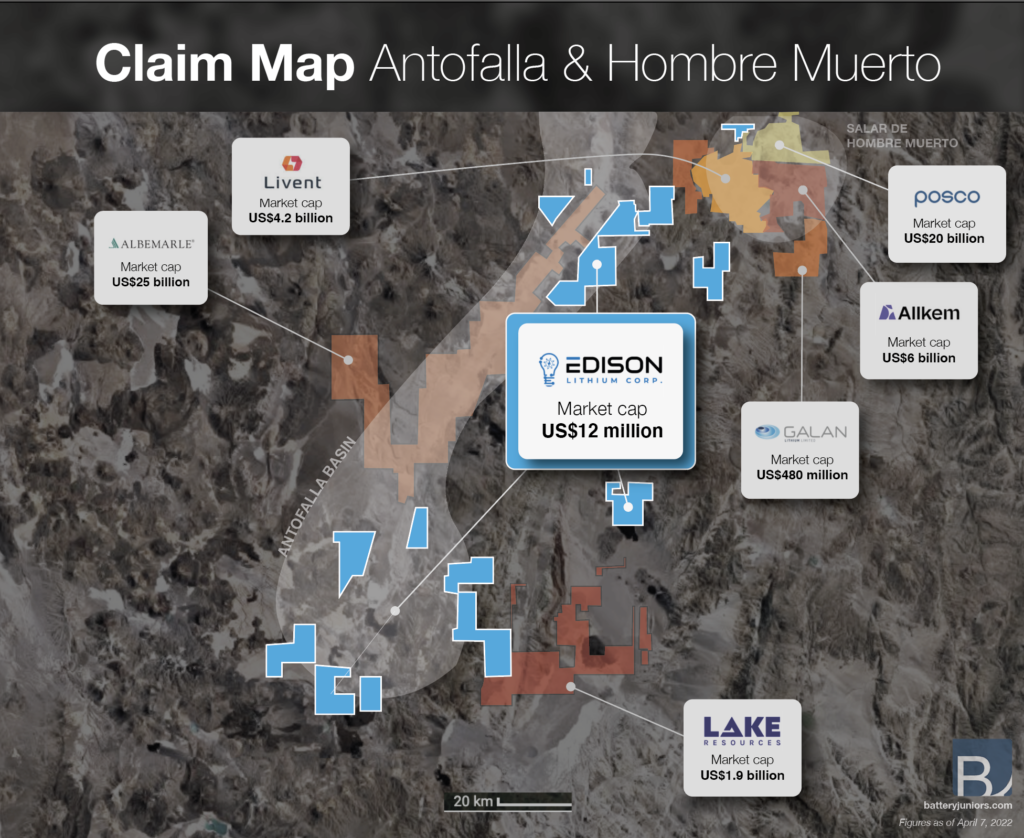

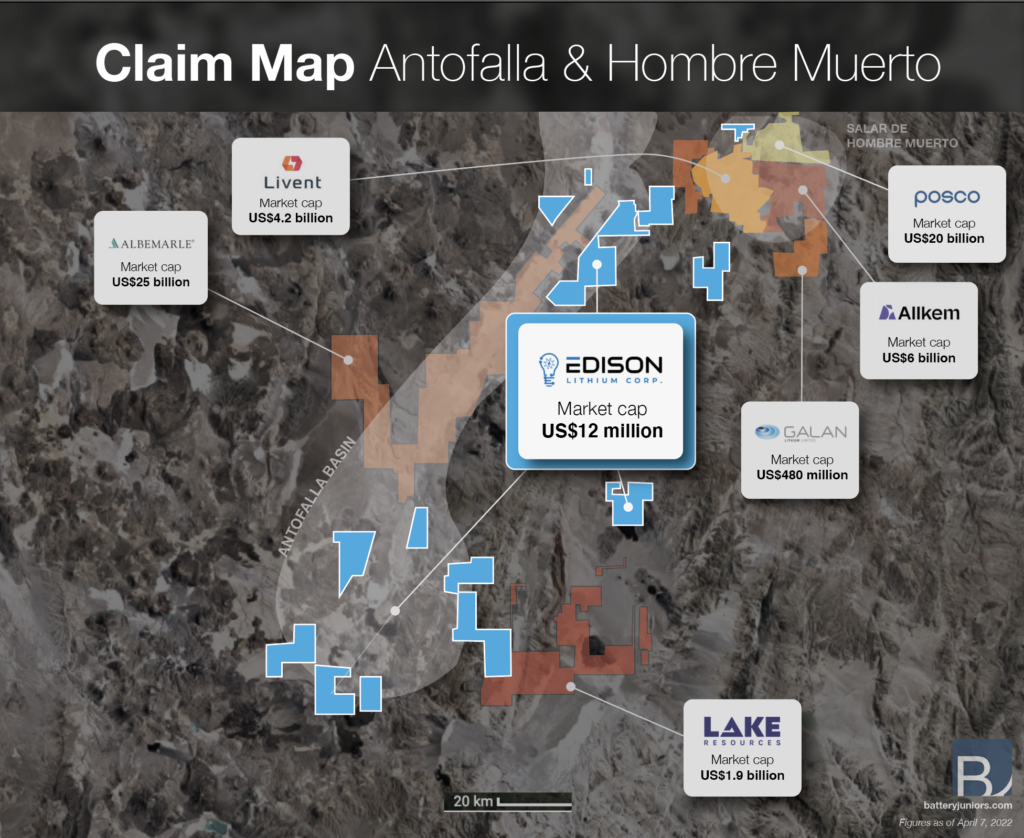

Project location: Close to major producers

The company's main focus is on the Antofalla project, located adjacent to Albemarle's claims in the region. Edison's claims are also close to Hombre Muerto Salar, with producers such as Livent, Posco and Galaxy Resources/Orocobre.

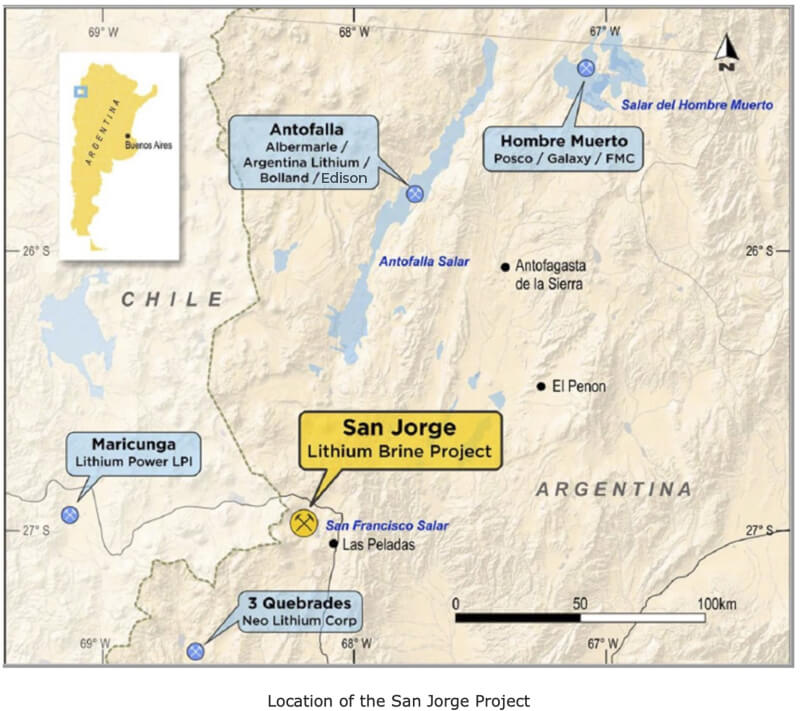

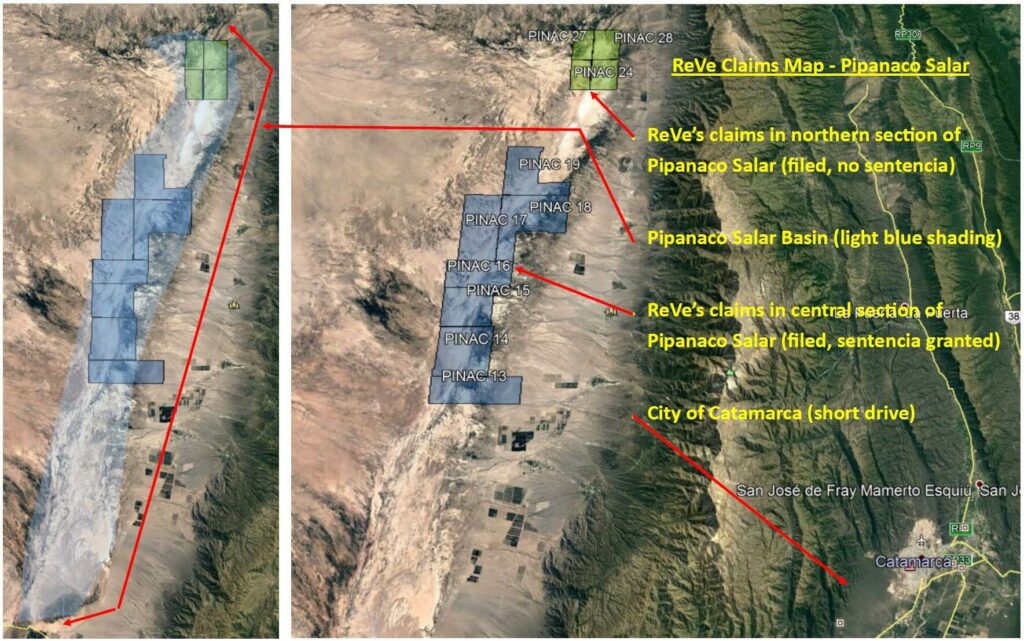

In June 2021, Edison Lithium acquired a 100% equity interest in Resource Ventures S.A., a Catamarca, Argentina-based lithium exploration company. Resource Ventures owned or controlled the rights to more than 148,000 hectares (over 365,700 acres) of prospective lithium brine claims in Argentina, primarily located in two geologic basins in northern Catamarca Province, Argentina known as the Antofalla Salar and the Pipanaco Salar.

Demand for lithium is increasing rapidly due to the proliferation of electric batteries dependent on the mineral. McKinsey forecasts the battery cell market will grow at a minimum of 20% per year through 2030, which would put the global value at $360 billion. Depending on market conditions and the possible positive impacts of economies of scale, the firm believes the global electric battery market could plausibly reach $410 billion by that time.

Lithium brine project:

Antofalla

Catamarca, Argentina

Antofalla Project Summary

Salar

Antofalla

Total Area of Claims

107,000 ha

Hectares

Stage:

TR

Technical Report

Location: Catamarca, Argentina

Next Stage: TR

Deposit type: Brine

Website: www.edisonlithium.com

Company description

“ (Edison Lithium’s) assets in and around the Antofalla Salar are made up of approximately 107,000 hectares (264,397 acres) of semi-contiguous claims in the northern and southern parts of this salar, offsetting either side of Albermarle’s holdings in the center of this salar. This vast block of lithium claims creates what management believes are to be a very impressive entry point for EDDY as we enter the burgeoning lithium sector,”

Key takeaways:

1. Close proximity to world-famous Salar del Hombre Muerto

Located less than 20 km from Salar del Hombre Muerto, with active lithium producers such as Livent (FMC), Galaxy, Posco and other lithium junior miners such as Galan, Alpha Lithium, Lithium South Development Corp etc.

2. Large land package around the Antofalla Salar

With 107,000 hectares of land, the company holds claims on both sides of Albermarles holdings in the salar.

3. 56 boreholds over an area of 265 km² confirms a lithium grade of 350 mg/l

In 2016, Roskill information Services reported that Bolland had drilled 56 boreholes over 265 km² and defined a resource of 83mt of potash (KCl) grading 6,400mg/l and 2.22mt of lithium (11.8mt LCE) grading 350mg/l. Bolland’s test wells were drilled between 2008 and 2011 in the claim block now owned by Albemarle and were completed in conjunction with the Institute of Mineral Resources for the National University of La Plata in Buenos Aires (“Inremi”).

Lithium brine project:

Pipinaco

Catamarca, Argentina

Pipinaco Project Summary

Salar

Pipanaco

Total Area of Claims

41,000 ha

Hectares

Stage:

TR

Technical Report

Location: Catamarca, Argentina

Next Stage: TR

Deposit type: Brine

Website: www.edisonlithium.com

Company description

“Our initial emphasis will focus on developing our properties at Antofalla, as it is a globally renowned lithium basin. Our claims in the Pipanaco salar, while only early stage exploration, may prove to be strategic for a potential regional lithium processing facility located less than 50 km from Catamarca city. We believe this strongly positions the Company as a lithium player in South America’s famed lithium triangle, during an energy metals commodities bull cycle. Our growth will be accelerated by acquisitions within the lithium space.”

Key takeaways:

1. Located close to the city of Catamarca

Located less than 50 km from the city of Catamarca, it could represent a favorable site for a lithium extraction facility or a potash mine, as well as being a potential location to create a regional lithium processing facility located less than a two-hour drive from Catamarca city.

2. Initial efforts will focus on the Antofalla property

Management Team

Nathan Rotstein

CEO

- Mr. Rotstein has over 45 years of experience in the financial markets.

- He has consulted with numerous companies in the energy metals sectors including but not limited to cobalt, manganese, graphite and lithium.

- Nathan also has an extensive global network comprising international funds and high net worth individuals.

Dr. Luisa Moreno

COO

- Over 12 years of experience in technical and economic research

- Dr. Moreno possesses strong insight into materials processing and metallurgy of industrial and precious metals and an astute understanding of supply and demand dynamics.

- Worked for 15 years as a geophysical contractor for C.D Hudston & Sons Ltd.

- Published a number of advanced technical reports on key strategic materials, and is a sought after consultant to numerous mining and processing companies and industrial end-users.

- Dr. Moreno is a Physics Engineer with a Ph.D. in Materials Science and Mechanics from Imperial College London, in the United Kingdom.

James A. Richardson

CFO

- James A. (Jay) Richardson is a Canadian Chartered Accountant, a Singapore Certified Public Accountant and a Fellow of the Insolvency Practitioners’ Association of the United Kingdom

- He has practiced as a Partner of Clarkson Gordon Arthur Young (now Ernst & Young, Canada and Singapore) and a Partner of KPMG (UK) prior to establishing his own practice as a company doctor in Toronto, Canada in 1993.

- He has extensive public company governance experience from over a dozen Board memberships including recently having served as Interim Chairman of the Argus Corporation

Roger Dahn

Director

- Over 40 years experience in the mining and exploration industry.

- His experience includes over 16 years with Noranda and Hemlo Gold Mines Inc., Exploration Manager of Eastern Canada for Battle Mountain Gold Company as Vice President Exploration with Olympus Pacific Minerals Inc., and most recently Tri-Star Resources plc. Mr. Dahn is currently Chairman of the Board at Manganese X Energy Corp.

- Roger brings extensive mineral exploration experience to the Company, a registered professional geologist and Qualified Person as defined by National Instrument 43-101.

Martin Kepman

Head Advisor

- Martin Kepman and Associates Inc, founded in 1982, is a business development and management consulting firm owned and operated by its president Martin Kepman.

- Martin, in his 34 years of consulting experience, has consulted on a wide range of projects, in multiple industries ranging from software , soft goods, printing, food to mining. Martin is also the CEO of the junior mining company Mangenese X.

Gordon Jang

Director

- Gordon was previously the Vice-President of Finance and Accounting at Fortuna Silver Mines and held senior positions at Augusta Resources, Lundin Mining and Pan American Silver and brings a wealth of experience in the capital markets, mergers and acquisitions, SOX compliance, tax planning, corporate structuring, process improvements and regulatory compliance.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)