The Self-Correcting Nature of Low Prices in the Lithium Market

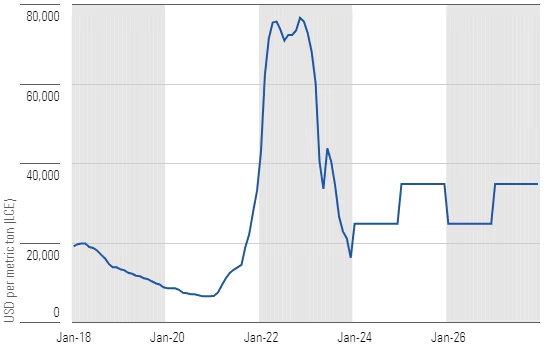

In the market, there’s a prevailing notion that “low prices cure low prices”. While this principle isn’t always a certainty, the significant drop in lithium prices has led some established producers to consider Care and Maintenance (C&M) strategies or stockpiling (The Motley Fool Australia), potentially reducing market supply. This response to unsustainable operating costs at current spot prices could be a key factor in the market’s potential self-correction .

Expert Analysis: Diverse Perspectives on the Market

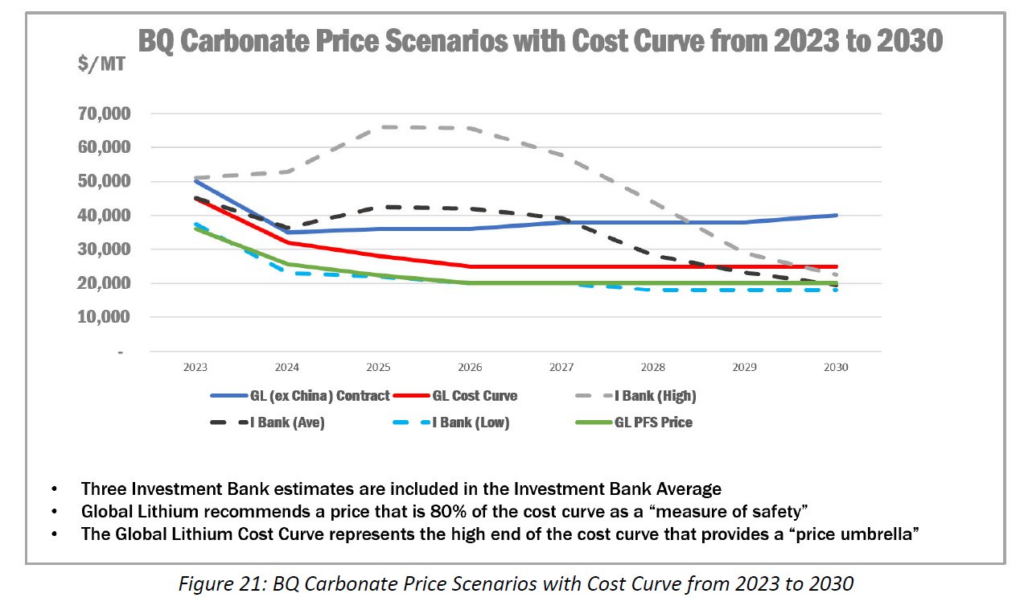

While the market dynamics might suggest a potential rebound, analysts offer a balanced perspective. For instance, Goldman Sachs predicts that lithium prices may not stabilize until 2025, indicating a longer duration of low prices than some market participants might expect. This cautious outlook is echoed in the Federal Government’s resources and energy quarterly report, which forecasts a continued decrease in lithium prices in 2024 due to a global production surplus.

Morningstar’s Long-Term Outlook

Morningstar’s analysis adds another dimension to this discussion. They project that lithium demand will more than triple by 2030, driven by EV sales. Despite the current price drop, they anticipate a recovery in lithium prices, averaging around $30,000 per metric ton from 2023 to 2030 (Morningstar).

Joe Lowry’s Insightful Prediction

Adding to these perspectives is Joe Lowry, a renowned lithium market expert. In an interview with Stockhead, Lowry shared his outlook for the lithium market, stating, “The price drop of 2023 will slow financing for many projects that have marginal economics with prices below $20,000/MT. I expect lithium chemical supply to be close to balanced but as inventories are rebuilt in China, price will begin to rise sometime in 2024. The excess in ore and low grade precursors from Africa may remain but gradually be used by converters that blend them into their systems.” He believes “the bottom happens by the second half of 2024 at the latest” (Stockhead).

Andy Leyland’s Analysis on Lithium Market Dynamics

Andy Leyland, another industry expert, provides further insights into the lithium market. In a recent tweet, Leyland noted that the lithium market is finely balanced for 2024. Despite being in surplus, the market has largely destocked after several months of falling prices. SC Insights analysts in China report inventory levels at only 5-6 days at some non-integrated refining facilities, and low stocks at cathode plants. This indicates that a restocking cycle and price recovery are highly likely, regardless of whether the market is in surplus or not. Leyland also mentioned that the modelled surplus of 24,000 tonnes LCE in 2024 only equates to 7-8 days of consumption and could easily be wiped out, suggesting that the narrative of a surplus in the lithium market might not be as straightforward as it seems (Andy Leyland’s Twitter).

Conclusion: Navigating the Lithium Market’s Complex Terrain

The lithium market is at a pivotal point, with low prices leading to reduced supply and hesitant new investments, against a backdrop of strong demand and cautious yet hopeful expert predictions. Stakeholders should navigate this terrain with a comprehensive understanding of these dynamics, preparing for potential scenarios that could unfold in the short to medium term.

References and Further Reading

- “Have Lithium Prices Finally Bottomed?” – The Motley Fool Australia. Read more.

- “Basic Materials: As Sector Underperforms, We See Strong Opportunities” – Morningstar. Explore the analysis.

- “Clouds clearing? Lithium price bottom will hit by second half of 2024, believes ‘realistic bull’ Joe Lowry” – Stockhead. Read Joe Lowry’s insights.

- Andy Leyland’s Twitter Analysis on Lithium Market Dynamics. View the tweet.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)