The lithium market, pivotal for the battery industry, has been on a rollercoaster ride in 2023. With the world’s accelerated shift towards renewable energy and electric vehicles, lithium, an essential component in rechargeable batteries, has been in high demand. However, the paradox of 2023 lies in the juxtaposition of an oversupply and the anticipation of a massive demand surge.

The Oversupply Conundrum

Albemarle Corp, the world’s leading lithium producer, is anticipating a dip in its quarterly profit. This is primarily attributed to the plummeting lithium prices, a direct consequence of the market’s oversupply. Despite the global push for electric vehicles and renewable energy, the immediate demand hasn’t matched the available supply, leading to this price decline.

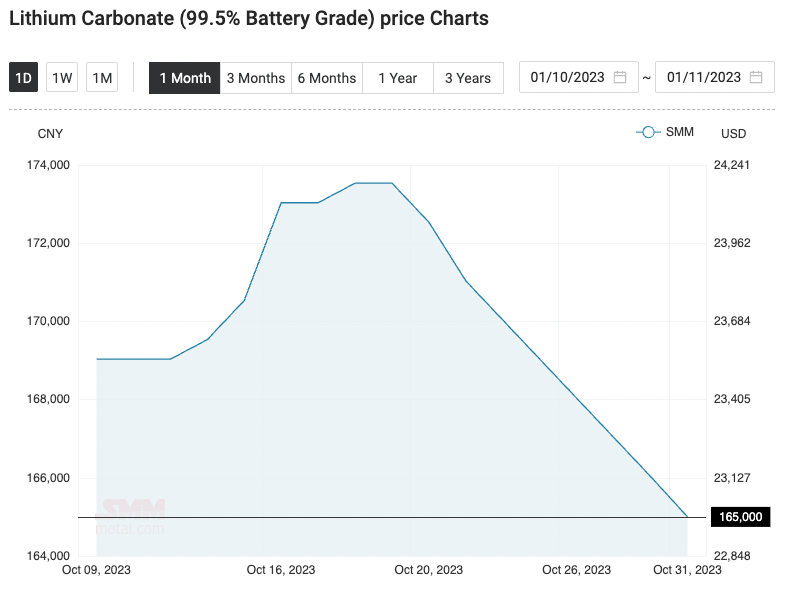

China’s Lithium Market Dynamics

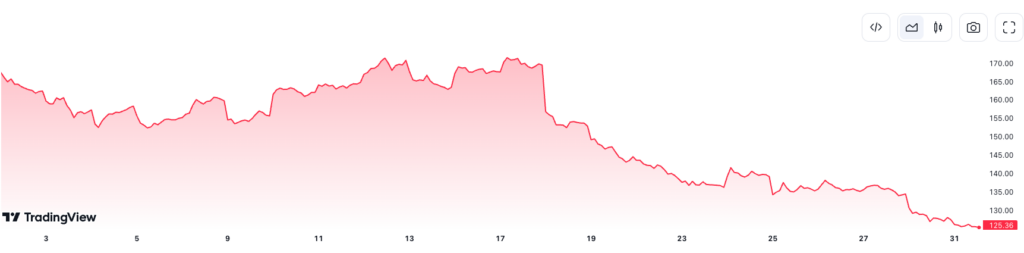

China, a dominant force in the global lithium market, mirrors this oversupply trend. The country’s lithium carbonate prices have been on a downtrend, especially noticeable in the week ending Thursday, October 26. This decline is a result of a bearish market sentiment combined with limited immediate demand. Conversely, lithium hydroxide prices have remained stable, not due to high demand, but because of limited trading activity.

Global Lithium Price Echoes

China’s lithium market dynamics aren’t an isolated phenomenon. The ripple effects have resonated across the globe. Major markets, spanning Europe to the United States, have echoed China’s sentiment, reporting a similar downward trend in lithium prices. This synchronized price movement across East Asia and the West underscores the universal challenges confronting the lithium industry. With consumer demand showing signs of fatigue and inventory levels reaching new highs, the situation becomes even more complex.

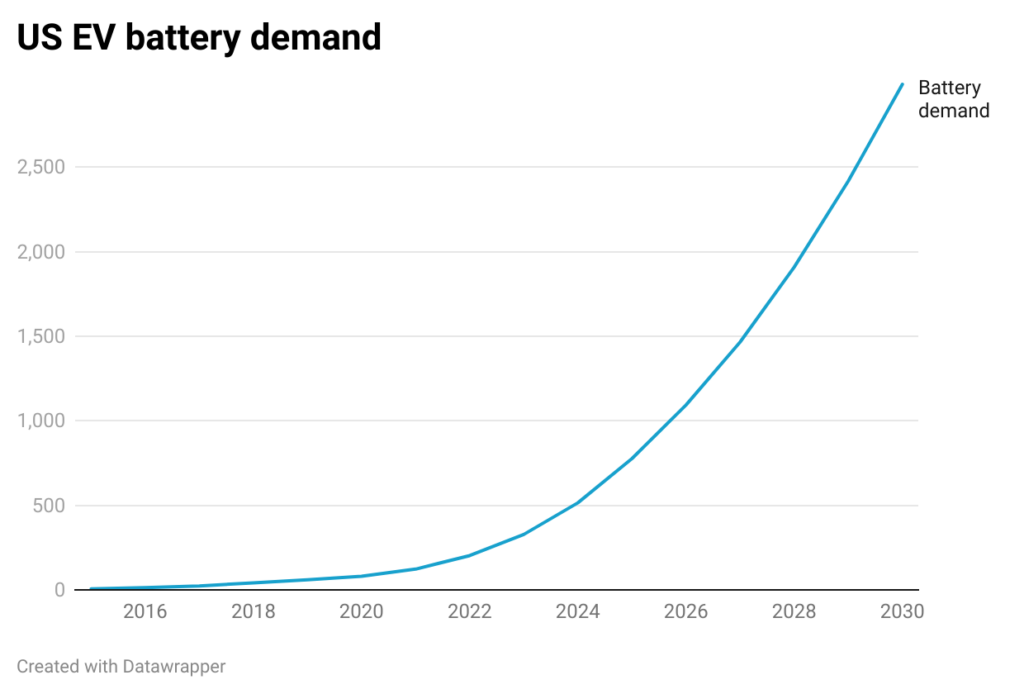

The Upcoming Demand Challenges

While the present scenario paints a picture of oversupply, the future tells a different story. With projections indicating the sale of over 350 million EVs globally by 2030, the looming question is: are we prepared to meet this skyrocketing lithium demand? The current methods of extracting lithium, although abundant, are slow and not environmentally friendly. This is where the challenge intensifies. By 2030, the demand for lithium is set to almost double the supply.

Connecting the Dots

The lithium market’s trajectory in 2023 is a tale of two contrasting phases. The initial oversupply, resulting in plummeting prices, sets the stage. However, as we look ahead, the shadow of an impending demand surge looms large. Bridging the gap between this oversupply and the anticipated demand will be the industry’s most significant challenge, requiring innovation, foresight, and strategic planning.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)