Argentina is on track to become Latin America’s leading lithium producer, potentially surpassing Chile, as the momentum behind its lithium mining boom continues to grow. With lithium being a critical component of the energy transition, used in electric vehicles, cellphones, and rechargeable batteries, the demand for this valuable resource is skyrocketing. Currently, Argentina has two lithium extraction projects, with 10 more under construction. Analysts predict that Argentina’s lithium production will increase fivefold next year and tenfold by 2027. However, the trajectory of Argentina’s lithium production is contingent upon the upcoming presidential election and the country’s macroeconomic outlook, which could impact the progress of the global energy transition and hinder supplies needed for the electric vehicle revolution.

Market Cap: $CAD 13.73M

Project: Yergo Lithium Project

Portofino Resources has recently completed the acquisition of the Yergo Project Option agreements, granting the company full control over the Yergo Lithium Project in Argentina. This strategic move allows Portofino Resources to advance its drill permit application and proceed with a planned 4-hole drill program. The company’s exploration team believes that the lithium-bearing brines of the Yergo Lithium Project and Zijin’s 3Q Project may be interconnected, further enhancing the project’s potential. With four priority drill targets identified and a drilling contract finalized, Portofino Resources is well-positioned to capitalize on Argentina’s growing lithium market.

Market Cap: $CAD 30.55M

Project: Hombre Muerto North Lithium Project (HMN Li Project)

Lithium South Development Corporation (TSX-V: LIS) has recently installed the first production well at its HMN Li Project in Salta Province, Argentina. This significant milestone demonstrates the company’s commitment to advancing its lithium production capabilities. With the well being cased and screened, Lithium South Development Corp. is now preparing for a pump test to further evaluate the project’s potential. Additionally, the company is actively seeking quotations for the exploration of the Sophia II and Sophia III claim blocks to ensure a sustainable water source, a crucial component for lithium carbonate production. Situated near other major lithium developments in the region, the HMN Li Project positions Lithium South Development Corp. for success in Argentina’s thriving lithium market.

Market Cap: $CAD 140.23M

Projects: Arizaro Project, Molle Verde Project

Lithium Chile Inc. (LITH.V) has provided an update on its operations in Argentina and Chile, showcasing its commitment to expanding its presence in the lithium sector. In Argentina, the company’s two diamond drill holes at the Arizaro Project have encountered brine-rich formations, indicating significant resource potential. A prefeasibility study on the project is expected to be completed in April 2024, further solidifying Lithium Chile’s position in the market. In Chile, the company’s three diamond drill holes at the Molle Verde Project have also encountered brine, with two holes displaying good porosity. Additionally, Lithium Chile is actively exploring opportunities for partnerships and joint ventures in Chile’s lithium sector, further expanding its reach and potential for growth.

Market Cap: $CAD 60.33M

Project(s): Various lithium projects in Argentina

Argentina Lithium & Energy Corp. (LIT.V) has recently entered into a services agreement with Resource Stock Digest (RSD) for a 3-month advertising and marketing program. This strategic partnership will enhance the company’s visibility and promote its lithium projects in Argentina, meeting the growing demand from the battery sector. With a strategic investment from Peugeot Citroen Argentina, a subsidiary of Stellantis N.V., Argentina Lithium and Energi Corp. is well-positioned to capitalize on the country’s lithium mining boom. The company’s focus on acquiring lithium projects in Argentina aligns perfectly with the increasing demand for lithium, making it a key player in the region’s lithium market.

Market Cap: $CAD 198,42M

Project(s): Various lithium projects in Argentina & Canada

Galan Lithium Limited (GLN.AX) has entered into a binding JV agreement with Redstone Resources Limited to acquire 100% of the Taiga, Camaro, and Hellcat Lithium Projects in the James Bay lithium province. Initial exploration identified 28 prospective pegmatite dykes. The projects are adjacent to significant discoveries by Patriot Battery Metals Inc. Additionally, Galan and Redstone have secured an option to acquire the PAK East and PAK Southeast Lithium Project in Ontario’s Electric Avenue. These acquisitions bolster Galan’s exploration portfolio in renowned lithium provinces.

As Argentina’s lithium mining boom gains momentum, these five companies are well-positioned to benefit from the country’s growing lithium production. With their respective projects and strategic initiatives, Lithium South Development Corp., Portofino Resources, Lithium Chile, and Lithium Argentina and Energi Corp are poised for success in Argentina’s thriving lithium market. However, the outcome of the upcoming presidential election and the country’s macroeconomic outlook will play a crucial role in shaping the future of Argentina’s lithium production and its impact on the global energy transition.

Read Top 5 Lithium Stocks Benefiting from Argentina’s Exploration Boom

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)

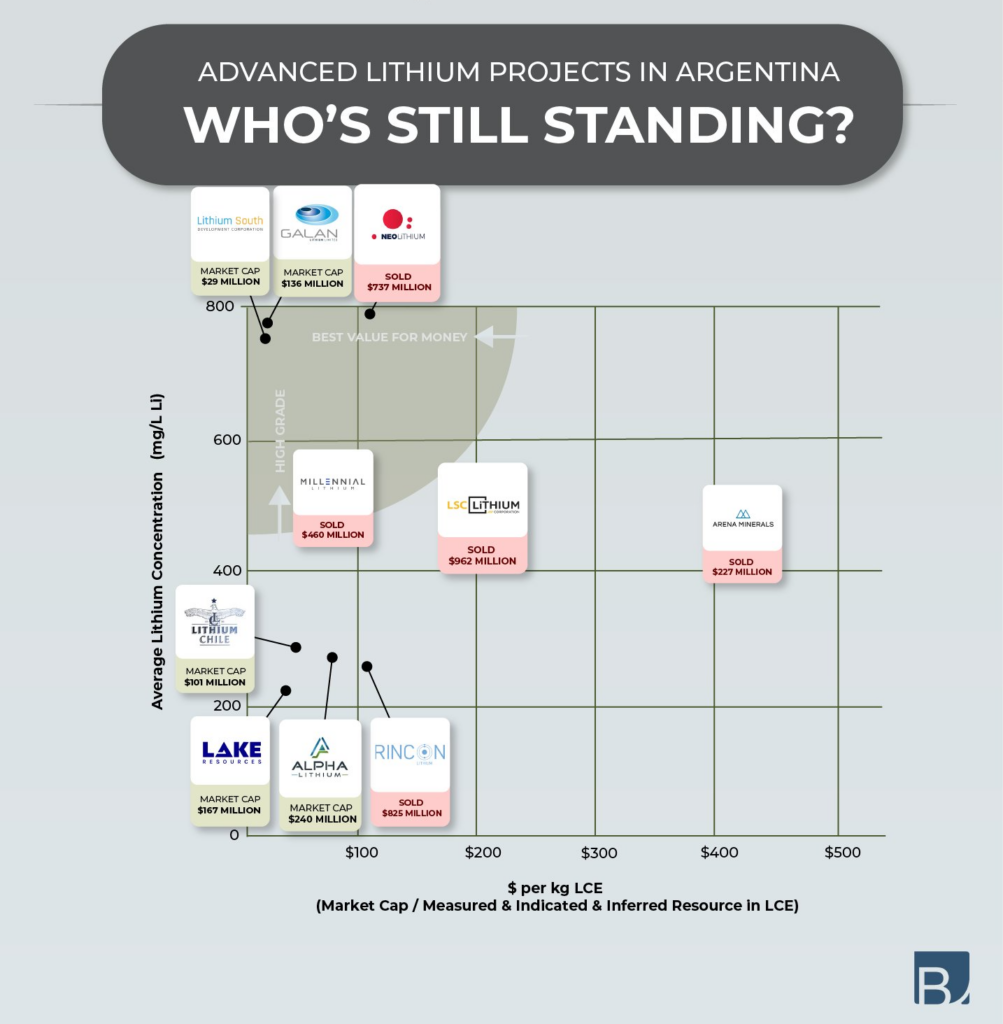

Lithium energy on asx (LEL.AX) still getting no love. Cad60m market cap for its 3.3mt lce resource on the olaroz salar in Argentina right next to producers allkem and lithium Americas.

I agree Tim, the cause of the low valuation is likely the Argentine election, the macro landscape and the overall lithium sector (low spot price). LEL’s potential is still there. The same goes for other promising Argentine lithium stocks, like Galan lithium, Lithium South and Lithium Chile