Liontown Rejects Albemarle’s US$3.7 Billion Proposal

Liontown Resources, an Australian battery metals exploration company, has rejected a non-binding indicative proposal from leading lithium producer Albemarle Corp. The offer valued Liontown at A$5.50 billion (US$3.66 billion), but the company’s board unanimously determined that the proposal significantly undervalues Liontown, making it an unsuitable deal for shareholders.

Offer Details: A 63.9% Premium

Albemarle’s proposal amounted to A$2.50 per share, which represents a 63.9% premium to ASX-listed Liontown’s last closing price. However, despite the substantial premium, Liontown’s board believes the company’s potential and value were not accurately reflected in the offer.

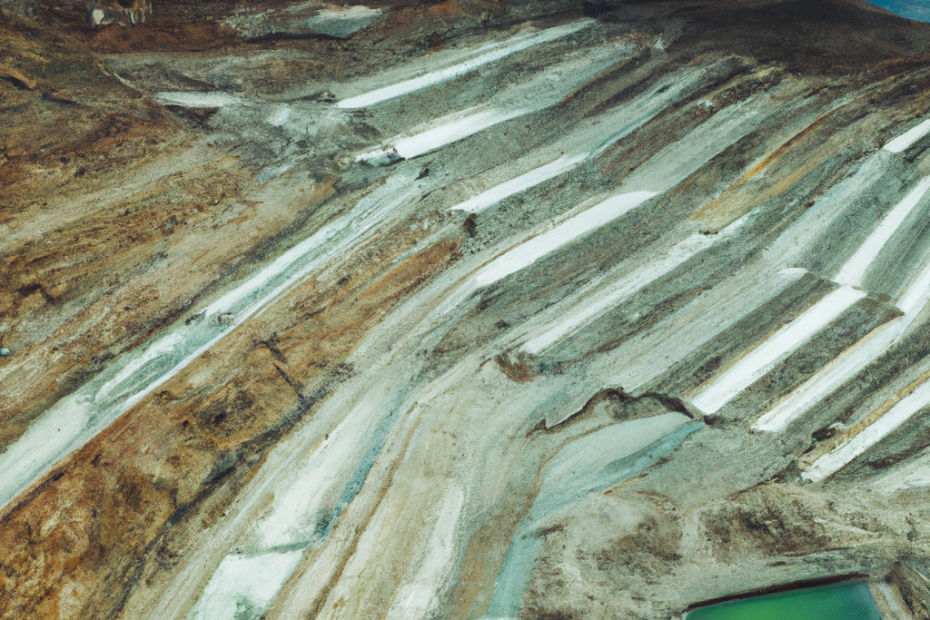

Liontown’s Lithium Deposits in Western Australia

Currently, Liontown Resources controls two major lithium deposits in Western Australia, including its flagship Kathleen Valley project. The project is among the world’s largest and highest-grade hard rock lithium deposits, as stated on the company’s website.

Albemarle’s Subsidiary Builds Stake in Liontown

Liontown recently became aware that RT Lithium Ltd, a subsidiary of Albemarle, has been accumulating a stake in the company through on-market purchases. RT Lithium now holds a near 2.2% stake in Liontown, which further highlights the growing interest of Albemarle in the battery metals explorer.

Albemarle: World’s Largest Lithium Producer

Based in Charlotte, North Carolina, Albemarle is the world’s largest lithium producer, with significant facilities in Chile, China, and Australia. Its interest in Liontown highlights the increasing importance of lithium as a key component in the rapidly expanding electric vehicle and energy storage markets.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)