The Lithium Triangle in Argentina is witnessing a transformative wave, notably underscored by Stellantis N.V.’s remarkable $90 million investment into Argentina Lithium & Energy Corp. (TSX-V:LIT), an early-stage explorer without a defined lithium resource. This significant financial move not only propels LIT into a new sphere of possibilities but also casts a spotlight on other promising entities in the region, such as Lithium South Development Corp. (TSX-V:LIS). This exploration delves into Lithium South’s potential and future, navigating through a market electrified by strategic investments and a global shift towards electrification.

The Stellantis-LIT Alliance: Signifying a New Era in Lithium Investments

Stellantis’s strategic investment into LIT, despite it being in a very early stage and without a defined lithium resource, has not only fortified its lithium supply chain but also set a new precedent in the valuation and strategic positioning within Argentina’s lithium exploration and production sector. This alliance, which includes a 19.9% stake and a 7-year lithium offtake agreement, emphasizes the critical role of lithium in powering the expanding EV market and paves the way for future significant investments in the sector, even in early-stage explorers.

The Ripple Effect: Navigating the Industry Towards Strategic Lithium Alliances

Stellantis’s substantial investment in LIT, despite its early stage, could potentially catalyze a shift in investment dynamics within the lithium exploration sector in Argentina. This pivotal move may guide other automakers, industry stakeholders, and Original Equipment Manufacturers (OEMs) to form similar partnerships with lithium explorers, safeguarding their lithium supply chains amidst the skyrocketing demand from the EV sector. Consequently, Lithium South, with its advanced developer stage and defined resources, could draw similar strategic investments and partnerships, emerging as a crucial player in the global lithium market.

Lithium South: Carving Out a Niche in the Lithium Triangle

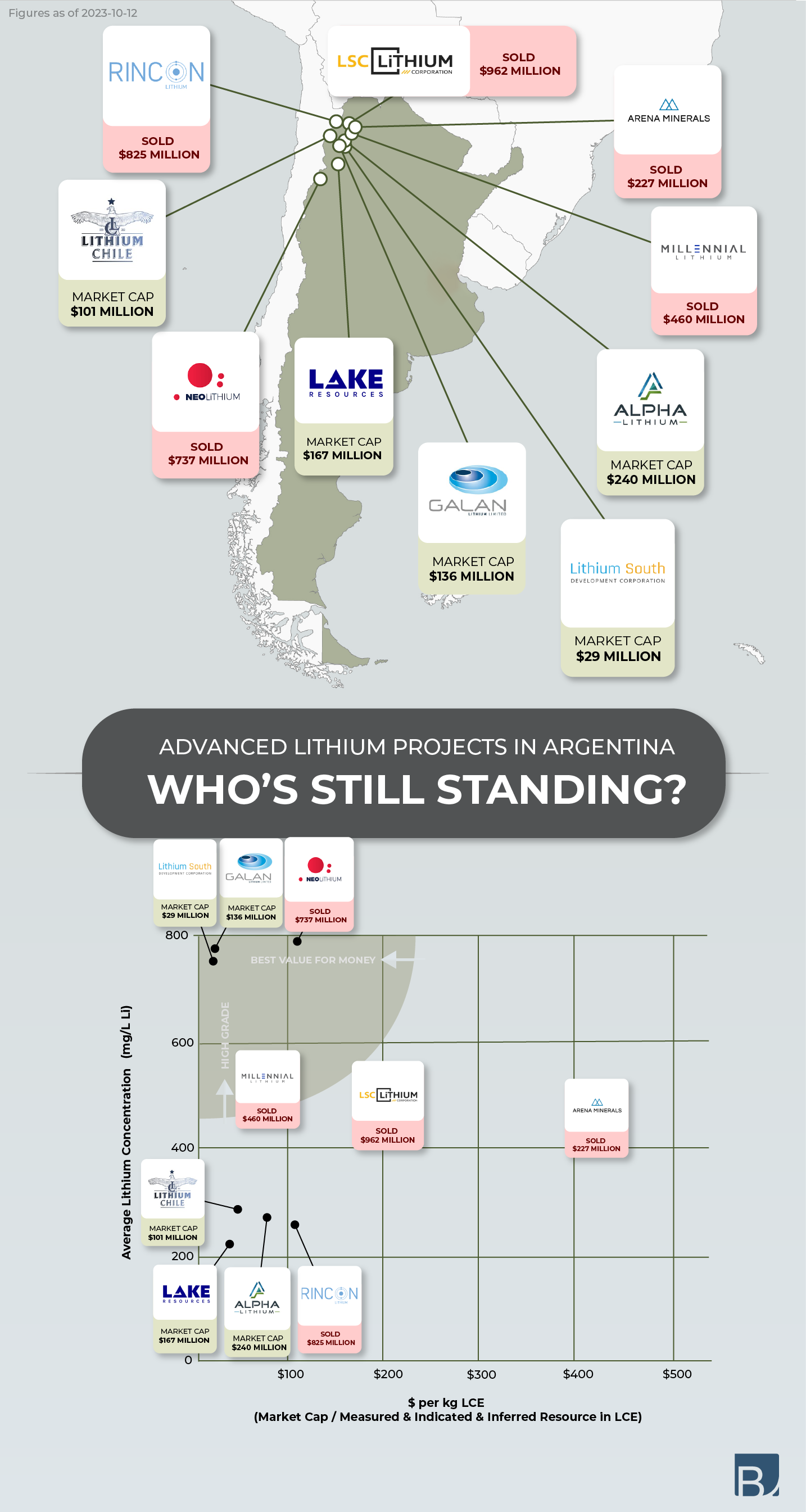

Lithium South Development Corporation, now positioned as a lithium project developer, is poised to attract strategic investments and partnerships. This could enable it to emerge as a significant player in the global lithium market.

Through its Hombre Muerto North Lithium Project, Lithium South is gearing up to advance the project to a Feasibility Study stage.

With the Korean giant, POSCO, finalizing a $4 billion U.S. lithium development in the neighboring area, and given Lithium South’s highly defined lithium resource, the company is both geographically and strategically positioned to establish a substantial presence in the lithium market. Its resource is classified as 90% in the measured category, which is the highest classification before being deemed a reserve. The company has also successfully carried out a resource expansion program, resulting in a 175% increase in its Lithium Carbonate Equivalent resource. This expansion bolsters its potential production capabilities and enhances its attractiveness to investors in the lithium market.

Furthermore, Lithium South has embarked on a pumping/production well drilling campaign at the Hombre Muerto North Lithium Project (HMN Li Project) in Salta, Argentina. This Phase One program encompasses drilling three wells, as well as conducting well development and long-term pumping tests. These tests aim to ascertain brine transmissivity and the maximum flow of each well, supplying vital data for the forthcoming Feasibility Study. Notably, the lithium grade is impressively high, while contaminants like magnesium remain low.

Conclusion: Lithium South at the Nexus of Opportunity and Strategic Innovation

Lithium South, steering through the dynamic landscape of lithium investments and strategic partnerships, finds itself at a promising nexus. With the lithium market in Argentina continuing to evolve, driven by landmark deals like that between Stellantis and LIT, Lithium South’s journey offers a captivating exploration into the opportunities and innovations within the lithium exploration and production sector in the Lithium Triangle.

Disclaimer

The content of this article is for informational purposes only and should not be construed as investment advice. It is always recommended to conduct your own research and consult with a financial advisor before making any investment decisions. Additionally, this article has been sponsored by Lithium South, and is part of an ongoing advertisement contract budgeted for a total cost of €100,800 (news release September 14, 2023) This advertisement is not an offer to buy or sell securities.

Mr. William Feyerabend, a Consulting Geologist and Qualified Person under N.I. 43-101, participated in the writing of this advertisement and approves of the scientific and technical content.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)