(via TheNewswire) CALGARY, ALBERTA – TheNewswire – August 8, 2023 – Lithium Chile Inc. ( TSXV:LITH ) ( OTC:LTMCF ) (“ Lithium Chile ” or

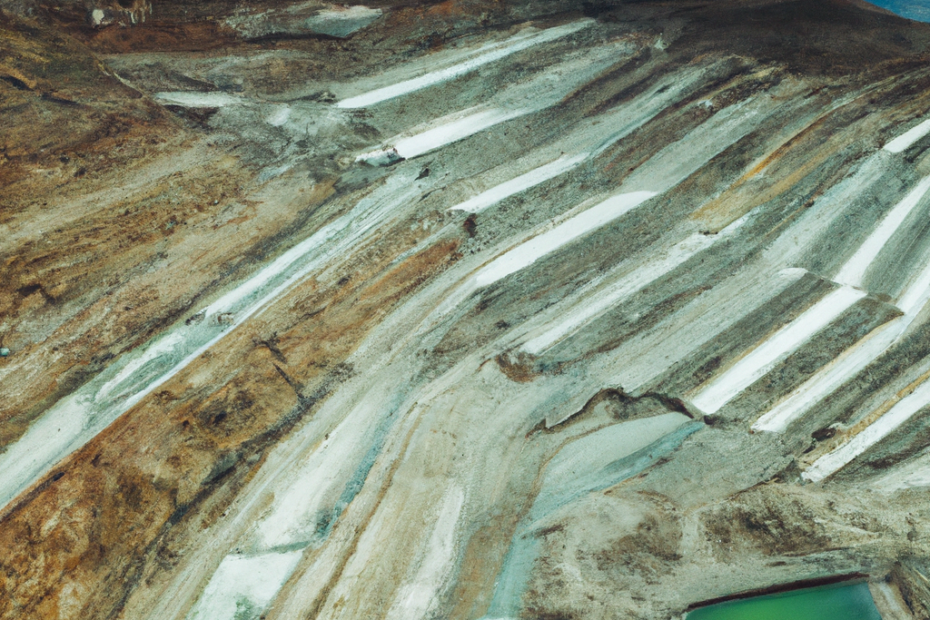

the “ Company ”) is pleased to report the results of its Preliminary Economic Assessment (“ PEA ”) for the production of lithium carbonate from its Salar de Arizaro lithium brine project in the Salta Province of Argentina (“ Arizaro ”). The PEA provides an independent economic assessment of the potential of Arizaro, based upon the lithium resources outlined in the July 2023 Resource Estimate.

ARIZARO PEA HIGHLIGHTS:

- Pre-tax Net Present Value (“NPV”) US$1.8 billion

- LOM Average Li CO price of $21.396 per tonne

- After-tax NPV $1.1 billion

- Pre-tax Internal Rate of Return (“IRR”) of 29.3%

- After-tax IRR of 24.1%

- PEA mine and processing plant produces 25,000 LCE LOM over 19.1 years.

- Pre-tax initial capital payback period 3.5 years; after-tax payback 3.6 years

- Average LOM annual pre-tax cash flow over operating period: $329 million; annual after-tax cash flow: $229 million.

- Initial Capital Costs (“Capex”) estimated at $823 million.

- Operating cost (“Opex”) estimated at $5,197/t LCE.

The PEA was completed by Ausenco Chile Limitada (“ Ausenco ”) in accordance with National Instrument 43-101 Standards of disclosure for Mineral Projects (NI 43-101). The assessment includes and demonstrates that the Arizaro project has the potential of a 25,000 tonnes per annum (“ tpa ”) commercial-scale operation to produce battery-grade lithium carbonate (“ LCE ” or “ Li2CO3 ”).

Under the leadership of President and CEO, Steve Cochrane and President of South America, Jose de Castro Alem, Lithium Chile has achieved key milestones which has culminated in the successful completion of the PEA. Mr. Cochrane remarked, “The filing of this technical report is another important milestone. These results support our view that the Arizaro Project has the potential to be a world class producer of Lithium Carbonate. We are excited about continued advancement of this project – a continuing journey of near-term enhancement opportunities that have already been identified.”

Lithium Chile’s President, South America, Jose de Castro says: “We are very proud of our entire Argentinian team, whose previous unique experience in starting up other Lithium projects has worked in creating real value for all stakeholders in the Arizaro project, including communities in which we work, as well as all shareholders of Lithium Chile. We have achieved in less than 2 years this important step and we are confident in advancing quickly to eventual production”.

ECONOMIC ANALYSIS AND SUMMARY: Initial Capital Costs

The cost estimates include the initial investment and sustaining capital for a lithium concentration plant with an annual capacity of 25,000 tonne LCE.

Summary of Initial Capital Cost:

Source: https://www.stockwatch.com/News/Item/U-th1BOxF8b0X-U!LTMCF-20230808/U/LTMCF

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)