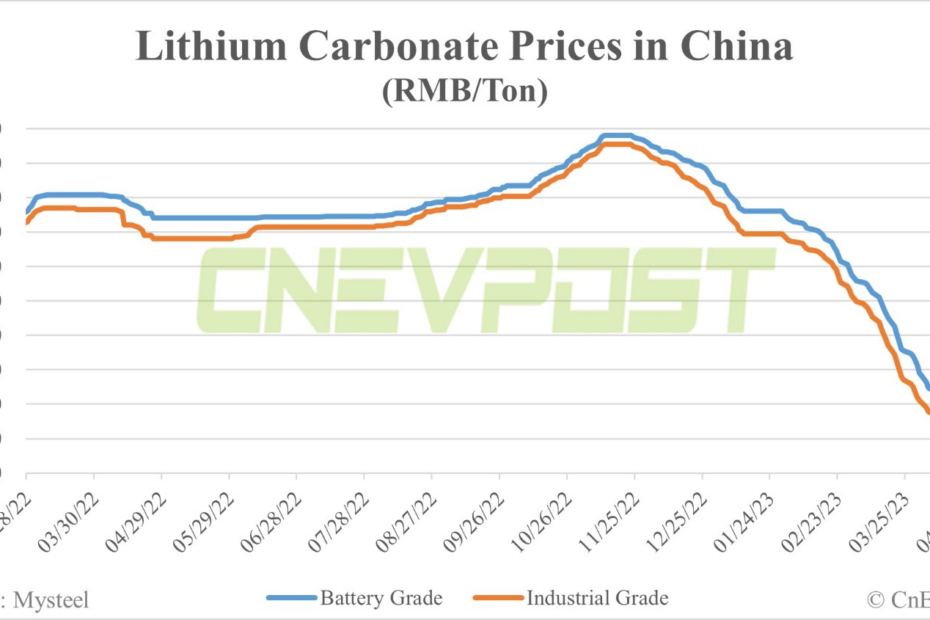

Signs of Lithium Price Stabilization

After a significant decline, lithium carbonate prices in China are showing signs of stabilization. Industrial-grade lithium carbonate price rose by RMB 2,500 ($362) per ton, averaging RMB 137,500 per ton, marking the first single-day increase this year. Battery-grade lithium carbonate remained at RMB 180,000 per ton for the third consecutive day, according to Mysteel data.

The Downward Trend and Oversupply Concerns

The lithium carbonate prices have been on a downward spiral, and half of Yichun’s four major lithium producers have shut down production to counter the trend. However, the global lithium supply remains in surplus. Analysts from Chinese brokerage CICC and CITIC Securities believe that lithium prices still have room to fall as the oversupply continues.

“We are also watching inventory levels across the supply chain,” he said. “That, plus an expectation for stronger demand in 2H means that prices will move higher again very soon.”

Cameron Perks, Benchmark Mineral Intelligence

Benchmark’s Brighter Outlook for the Lithium Market

Factors such as low material inventories and overseas lithium prices being at a significant premium to Chinese lithium prices are supportive of price stabilization. According to Benchmark Minerals, an industry consultant based in London, the price correction in China does not represent the entire market. The high cost of mining, the need to rebuild inventories, and a brighter outlook for battery storage and EV sales as the energy transition progresses could result in higher lithium prices soon.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)