Introduction

The lithium market is currently facing a perplexing situation, with Fastmarkets reporting a spodumene price increase from the previous $4,850 per tonne to a new price of $5,313 per tonne, while Chinese lithium carbonate and hydroxide prices continue to decline. This article will analyze quotes from industry experts Joe Lowry, Daniel Jimenez, and Matt Fernley to shed light on this situation, focusing on the impact of spodumene prices, Goldman Sachs’ predictions, and an update on demand from China’s new energy vehicle (NEV) sales.

Spodumene Price Surge and Chinese Lithium Carbonate Downtrend

Fastmarkets’ recent report highlights the unusual dynamics in the lithium market, with a spodumene concentrate price increase to $5,313 per tonne while Chinese lithium carbonate and hydroxide prices remain in a continuous downtrend. This divergence raises questions about the implications for the lithium price, the lithium supply chain and the potential effects on stakeholders, such as battery manufacturers and electric vehicle producers.

Spodumene Prices and Lithium Carbonate Costs

Daniel Jimenez highlights the current disconnect between spot spodumene prices and spot lithium carbonate (LC) prices in China. He points out that the spodumene concentrate price has increased to $5,313 per tonne, which translates to a lithium carbonate cost of $52 per kilogram, without any margin for the refiner. However, current spot prices for lithium carbonate in China are between $25 and $35 per kilogram, creating an apparent discrepancy.

Goldman Sachs Predictions and Market Impact

Joe Lowry criticizes Goldman Sachs’ prediction of lithium chemicals prices below the cost curve, suggesting that spodumene prices would need to fall below $2,000 per metric tonne for their Q2 carbonate number to be accurate. He questions whether the investment bank is buying shares in the companies that their research is negatively impacting. Lowry’s skepticism points to the potential influence of such predictions on market behavior and the possibility of vested interests playing a role.

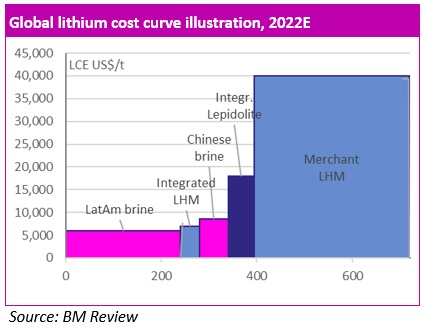

The Marginal Cost of Production and the Lithium Market

Matt Fernley argues that the marginal cost of production for lithium chemicals is closer to $40 per kilogram than $15 per kilogram, given the current spodumene concentrate prices. He suggests that, as lithium carbonate spot prices in China approach this level, Chinese merchant lithium converters relying on spodumene feedstocks will begin to shut down, as they become uneconomical.

Impact of Diverging Prices and Conversion Capacity Shutdown on Market Dynamics

The divergence between spot lithium carbonate and spodumene concentrate prices, along with potential conversion capacity shutdowns, could significantly impact the lithium market. As conversion facilities shut down, the available lithium carbonate supply may decrease, leading to tighter market conditions and potentially driving up lithium carbonate prices.

“I suspect we’ll see this complex market picture remain for some time, but if we view spot spodumene as indicative of expectations for chemicals prices in a few month’s time, I do think the recent higher levels achieved could be an early signal of a shift in trend.”

Peter Hanna, Fastmarkets

Growing Demand from China’s New Energy Vehicle Sales

Adding to the tight lithium market, the China Association of Automobile Manufacturers (CAAM) is reporting strong growth in NEV sales for March, including battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs), and fuel cell vehicles. These sales are up 34.8% year-on-year in March, with BEV sales growing 23.8% year-on-year. These figures suggest that the demand for lithium chemicals, particularly for battery production, is likely to remain strong.

Conclusion: Navigating the Lithium Market’s Complexities

The lithium market’s current conundrum, characterized by the divergence between spodumene and lithium carbonate prices, coupled with the potential shutdown of conversion capacity and growing demand from China’s NEV sales, presents a challenging landscape for industry stakeholders. As experts continue to analyze these dynamics, it is crucial for market players to closely monitor the lithium supply chain and remain vigilant of potential changes in the lithium market and the impact of influential predictions on prices and company valuations.

For investors, the potential turnaround in lithium prices might present an opportunity to take positions in the lithium mining space. These companies could benefit from the evolving market dynamics, as a tightening supply and growing demand could drive lithium prices upward in the future. By carefully navigating the complexities of the lithium market, investors and industry stakeholders can position themselves to capitalize on the evolving opportunities in the electric vehicle and energy storage sectors.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)