Open Letter to Shareholders

BRITISH VIRGIN ISLANDS / ACCESSWIRE / August 9, 2023 / Bradda Head Limited (AIM:BHL)(TSXV:BHLI)(OTCQB:BHLIF), the North America-focused lithium development group, this morning published an Open Letter to Shareholders from the Company’s Board of Directors outlining the ongoing positive indicators from the Company’s operational drilling, fieldwork, permitting efforts and strategic discussions in the US and Canada associated with all our US-based Projects.

It has been a productive few months for Bradda Head, with ongoing positive indicators from our operational drilling, fieldwork, permitting efforts and strategic discussions in the US and Canada associated with all our US-based Projects. This is not reflected in the valuation of our Company in the opinion of the Board.

In this letter, the Board wants to address the recent decline in our share price and provide an update on the status of our highly prospective Projects and emphasise why we believe our current share price level, which is significantly below our actual listing price, is undervalued and offers an extremely attractive entry level into Bradda Head.

Open Letter to Shareholders from Board of Directors of Bradda Head Lithium

It has been a productive few months for Bradda Head, with ongoing positive indicators from our operational drilling, fieldwork, permitting efforts and strategic discussions in the US and Canada associated with all our US-based Projects. This is not reflected in the valuation of our Company in the opinion of the Board.

In this letter, the Board wants to address the recent decline in our share price and provide an update on the status of our highly prospective Projects and emphasise why we believe our current share price level, which is significantly below our actual listing price, is undervalued and offers an extremely attractive entry level into Bradda Head.

First, let us consider the underlying fundamentals of our value for investors:

Investment Recap

Positive forecast for healthy lithium demand

· Electric vehicles and energy storage systems drive demand as supply growth remains challenged.

Continued and growing economic support

· The US, through the Inflation Reduction Act (IRA), is investing US$369 billion into its electric vehicle future, aiming to increase investment in critical minerals and develop the supply chains for these minerals in the US.

LRC Royalty

· The Company aims to receive the second royalty payment (US$2.5 million) after the next resource upgrade at Basin, which is forecast to be announced in H2 of this year.

Quality projects in top jurisdictions

· Reduced investment risk as a consequence of having all main recognised lithium mineralisation styles identified in our Projects, each with the potential to be a Company-maker.

· Our Projects, in Arizona, Nevada and Pennsylvania, are within the top mining jurisdictions globally. Arizona is the US state with the highest annual revenue from mining.

· There is strong National and State Government support for a range of Strategic Minerals to be supplied from within the USA itself. Lithium is identified as one of these strategically important minerals. Bradda Head is well placed, not only to attract attention from end users in the USA but to capitalise on this funding at the right time.

· Bradda Head has a strategic land package of 23kms2 for hard rock lithium exploration and development in Arizona. There is the potential scale to deliver a sizeable potential resource opportunity. Panmure Gordon’s initiation note (9th May 2023) independently indicates the potential for nearly 8Mt of LCE, as well as highlighting the proximity to genuinely world class infrastructure (roads and inexpensive, 100% renewable energy) found in very few other areas worldwide.

· Bradda Head has a large strategic land package of lithium-in-clay, (46kms2) also in Arizona. Drilling currently underway is expected to expand this resource. SRK has identified a JORC-compliant exploration target of 1Mt to 6Mt LCE.

· Our Lithium Brine projects in Nevada, namely Eureka and Wilson, are prospective opportunities. Both projects have clear geophysical anomalies, showing the presence of reservoirs with conductive fluids, indicating the potential presence of brine at both. We also see potential for a clay signature at Wilson.

· Bradda Head also has strategic land packages that have the potential to contain lithium-bearing brines associated with oilfield brines in Pennsylvania.

· The extraction of lithium from old oil brines has seen significant investment recently with the acquisition of lithium rights in the Arkansas portion of the Smackover formation for US$100M in May this year by Exxon Mobil which is now entering this space.

Bradda Head is funded for 2023.

· All projects are 100%-owned. Experienced Board and Management with a wide array of knowledge across the metals & mining space. Strategic positioning in the US for lithium end-users Our lithium projects are strategically located to supply the rapidly growing US domestic

market, with the benefit of:

a. US-produced low carbon footprint lithium

b. Strategic positioning in the US for lithium end-user

· All projects are 100%-owned.

News to look out for

San Domingo: proving up the district scale potential

Follow-up drill programme planned to start this quarter:

· This next drilling campaign is building on the successful initial maiden drilling programme from earlier in the year

· Our primary aim of this programme is delineating a Resource

Basin: resource growth on the way in H2

· Drilling underway at Basin East Extension and Basin North

· 2023 drilling targeting resource of over 1Mt, an expansion which would trigger the contractually agreed payment by LRC of a further $2.5 million.

· JORC Exploration target of up to 6Mt LCE at 17km2 Basin Project

Brine assets

Wilson and Eureka

· Bradda Head intends to demonstrate the potential value in our Nevada brine assets. The Company is interested in developing these projects itself or via JV investments, whilst naturally focussed on our most progressed projects (Basin and San Domingo) which we believe are most likely to increase value for shareholders in the short-term.

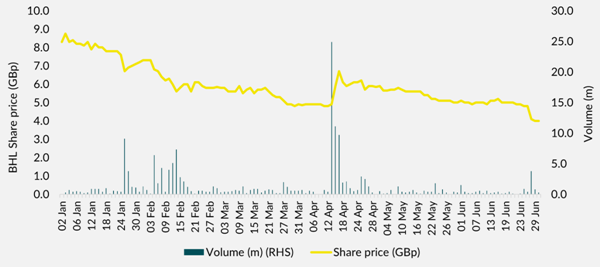

Share price performance (January to June)

Bradda Head’s share price was 8.8p on January 3, 2023. Since then, the share price has closed to a low of +/- 3.7p, a fall of close to 60%.

What are the market headwinds that have stalled the Company’s share price growth? Which are the factors that are external to the Company (i.e., things we cannot change) versus factors that are internal and under the control of the Company? Key factors highlighted to us by investors include:

· Spot lithium pricing weakness until mid-May 2023

· Mixed analyst outlook for lithium price

· Hard Rock Spodumene vs Li-bearing Brines

· Cash position

· Communication on the recently announced change of auditor.

Each of these is covered in more detail below.

Lithium pricing

Spot lithium pricing weakness until mid-May

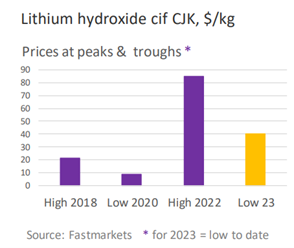

Spot Lithium prices in China declined from a high of around US$85,000/t in November 2022 to a low of near US$21,000t in May this year. Since then, the price has rebounded and is around the US$39,000/t mark. The price seems to have defined a new floor of US$22,000/t, the level below which a significant amount of lithium supply from non-integrated Chinese operations becomes uneconomic.

Lithium price outlook remains strong and recently, at the Fastmarkets conference, the chart to the left was presented by William Adams, Head of Base Metals & Battery Research at Fastmarkets, showing that the low in 2023 is considerably higher than the low in 2020 after the first lithium wave of high spot prices in 2018 (See Figure 1).

During the 2018 lithium price rise, the projects that rose to fill the supply gap were hard rock projects in Australia, while the brine producers in South America struggled to scale up production.

This is why Bradda Head has its targeted approach of all 3 main recognised types of lithium, with the focus now on resource delineation at its pegmatite district in Arizona where we see huge potential for value creation and resource expansion over 1Mt LCE at its Basin clay project demonstrating the scale potential.

Figure 1: Lithium Hydroxide high/low price 2018 to 2023

Analyst outlook for lithium price

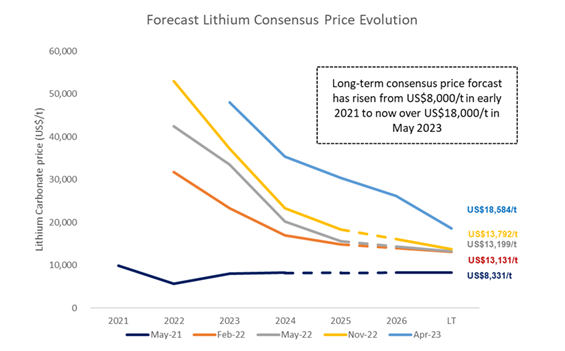

Bradda Head uses the long-term mean consensus price for its view on the market, which has increased from c.US$8,000/t back when forecast in early 2021 to now c.US$18,000/t as of consensus forecast May 2023, see Figure 4. What is clear to all lithium market watchers is the level of demand in lithium and also the supply needed, which historically has taken longer to get on stream (brines in South America) and been harder to scale up than other forms of lithium mining (hard rock projects in Australia)

Bradda’s projects are strategically positioned to fill the near, medium and long-term demand for lithium. Allowing the Company to move quickly in comparative valuation growth terms in the near-term as a consequence of it’s hard-rock project, which would use industry standard equipment and production flow sheets.

Figure 2: Lithium price consensus forecasts from May 2021 to April 2023

Hardrock spodumene vs. Li-bearing brines

DLE technology is developing but it is not yet proven on a wide commercial scale, but hard-rock mining is! Bradda Head is focussed on its second drill programme at its 23km2 pegmatite district in Arizona, due to start this month. This will, we believe allow us to report our first 43-101 compliant resource and push this Project forward towards production with pace. Bradda Head has already reported some significant Li20 interceptions at its San Domingo Project as highlighted in Figures 3[1] and 4[2] below from Q1 of this year:

Figure 3: Miner Deck analysis of Q1 lithium drilling intercepts with market caps added

Note: Red Dirt Metals name changed to Delta Lithium in April 2023

Figure 4: Bubble chart comparing Q1 assay intercept, grade and market caps. Bubble size is related to market cap.

The recent approval of Thacker Pass has added positive sentiment in the US and confidence is growing. Bradda Head is confident in the long-term market in clays, and we see Basin as a major part of the Company’s mid-term strategy whilst we develop San Domingo, the simpler and more cost effective hard-rock project.

Cash position

Bradda Head has sufficient cash reserves to carry out its planned 2023 drill programmes and we also expect that Bradda Head this year will receive its second royalty payment from LRC of US$2.5 million once we release our updated resource at Basin following the initial results from the current drill programme there.

Communication on change of auditor

Bradda Head released a premature RNS on June 28 relating to the delay in filing of its accounts, which in turn led to confusion in the market. Steps have been taken to ensure this does not happen again and Bradda Head released a clearing RNS on the 30 June adding detail to why the auditor change was required (due to the requirement for a CPAB registered firm, as we are now at TSX-V listed Company) and the request by Bradda Head for permission to file its TSX-V accounts late. These announcements are no reflection of the Company’s financial position and Bradda Head will be announcing its results in accordance with the AIM rules.

Summary

Bradda Head has strategically located critical mineral projects in the US, located in the middle of the burgeoning US battery supply chain that the government is funding growth of with nearly US$370bn of grants and low-cost loans.

Bradda’s asset mix gives the Company and its shareholders exposure to three different types of lithium projects, as all types have their advantages. The Company has near, medium and long-term exposure, and most importantly has work underway on its two flagship projects (hard rock and clay).

2023 will be a big year for Bradda as we aim to push our resources at Basin over the 1Mt LCE mark, which should trigger the next royalty payment and also kick-off the PEA. We are also shortly starting our second drill programme at San Domingo with the main aim to delineate a resource, which would dramatically change the Company’s valuation overnight.

This is the time to invest in Bradda before the 3rd wave of lithium investing hits the market.

Source: https://finance.yahoo.com/news/bradda-head-lithium-ltd-announces-101500045.html

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)