Zimbabwe is on the verge of a significant leap in the lithium industry, with Chinese investors playing a pivotal role. The African nation is set to become the world’s fifth-largest primary producer of lithium, a material crucial to the green revolution and the electric vehicle industry.

The lithium industry in Zimbabwe has seen rapid expansion, thanks to approximately $1 billion in investments from Chinese companies such as Zhejiang Huayou Cobalt, Sinomine Resource Group, Chengxin Lithium Group, and Yahua Group over the past two years. These companies, grappling with production constraints in their home country, have turned their focus to Zimbabwe to secure future lithium supplies.

The investments are projected to increase capacity to 192,000 tons of lithium carbonate equivalent (LCE) per year of petalite and spodumene by 2027, a significant rise from 13,000 tons per year LCE in 2022. This growth will position Zimbabwe as the fifth-largest primary producer of lithium by 2025, surpassing both Canada and Brazil.

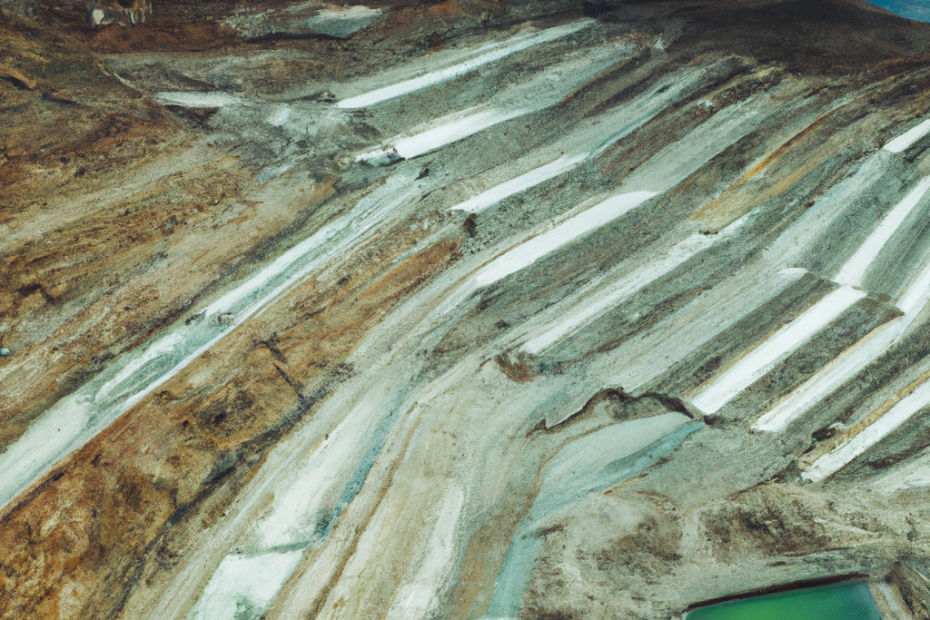

Zimbabwe, home to some of the world’s largest lithium deposits, has been mining the metal at Bikita Minerals since the 1950s. Sinomine purchased Bikita Minerals last year for $180 million and has invested an additional $300 million to expand the petalite and spodumene capacity.

The investments by Sinomine and others could increase Zimbabwe’s capacity to about 11% of global LCE production in five years, up from just 2% in 2020. However, full utilization of this capacity will depend on lithium demand and prices.

Despite the potential, softening prices may not support investments in marginal projects. Nevertheless, the speed at which Chinese investors have brought lithium to the market has exceeded expectations, making Zimbabwean deposits more attractive. The future of Zimbabwe’s lithium industry looks promising, with more investments and interest from China on the horizon.

![LOGO [återskapat] LOGO [återskapat]](https://batteryjuniors.com/wp-content/uploads/elementor/thumbs/LOGO-återskapat-ozpr6tyjh3va1ifcopltktksqownqc64mplxytts9k.png)